General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsCook political / popular vote / turrnout change maps

Last edited Thu Nov 14, 2024, 07:25 PM - Edit history (1)

California - down 19% turnout. See maps here

https://cookpolitical.com/vote-tracker/2024/electoral-college

https://www.cookpolitical.com/vote-tracker/2024/electoral-college

LeftInTX

(34,067 posts)andym

(6,063 posts)that's surprising. Especially given that is not true at the House level maps. Probably due to this being a "change" election due to cost of living.

BootinUp

(51,118 posts)BootinUp

(51,118 posts)For everyone generally speaking if Trump was in there the last 4 years.

andym

(6,063 posts)Interest rates would have risen as well due to the Fed's independence.

BootinUp

(51,118 posts)The main feature. We would be in worse shape in pretty much every measure .

BootinUp

(51,118 posts)It was a direct result of supply constraints.

andym

(6,063 posts)due to higher CC rates. Many Americans carry debt.

BootinUp

(51,118 posts)Rates under a Trump admin. That is fantasy.

Self Esteem

(2,248 posts)In the end, the soft landing maybe did more damage than good because it was such a slow process.

Had the Fed raised rates significantly early on, and forced the economy into a recession, inflation likely would have come down much faster in 2022 and 2023.

BootinUp

(51,118 posts)Not good enough.

BootinUp

(51,118 posts)Lies and propaganda.

Self Esteem

(2,248 posts)BootinUp

(51,118 posts)Universe scenario.

Self Esteem

(2,248 posts)No - inflation was not just caused by supply constraints. There were multiple factors that went into inflation rising the way it did.

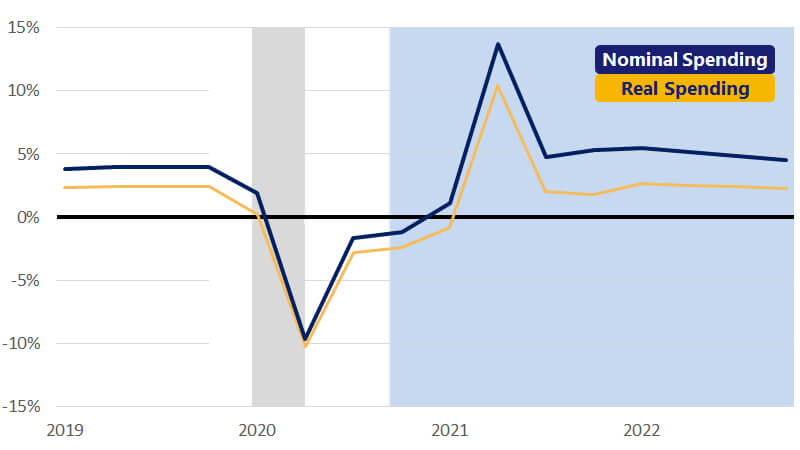

1. The economy was nearly shut down for an entire year. Americans didn't spend. The government handed out multiple stimulus checks. There were rent freezes and student loan freezes that meant millions of Americans were able to put away a ton of money throughout 2020. On top of that, you had the child tax credit that lifted a great deal of children out of poverty - again because we were giving Americans a lot of money.

2. When the economy opened up in 2021, people started spending - at a rate that we almost never see with the economy:

When consumers spend, demand goes up and when demand goes up, so do prices. Yes, the supply constraints didn't help but even if there wasn't supply issues, inflation would have continued to go up because Americans would have continued to spend and spend all that money they packed away in 2020.

3. One way to lower inflation significantly, and quickly, is to jolt the economy by forcing a recession. We saw this in the 1980s. The Fed, led by Paul Volcker, raised rates - and raised 'em way higher than what we've seen the last couple years:

Had Powell done as dramatic of an increase when it became apparent inflation was surging, the economy would have slowed significantly in 2021-2023 That would have limited spending, which would have loosened the demand and costs would not have risen as fast.

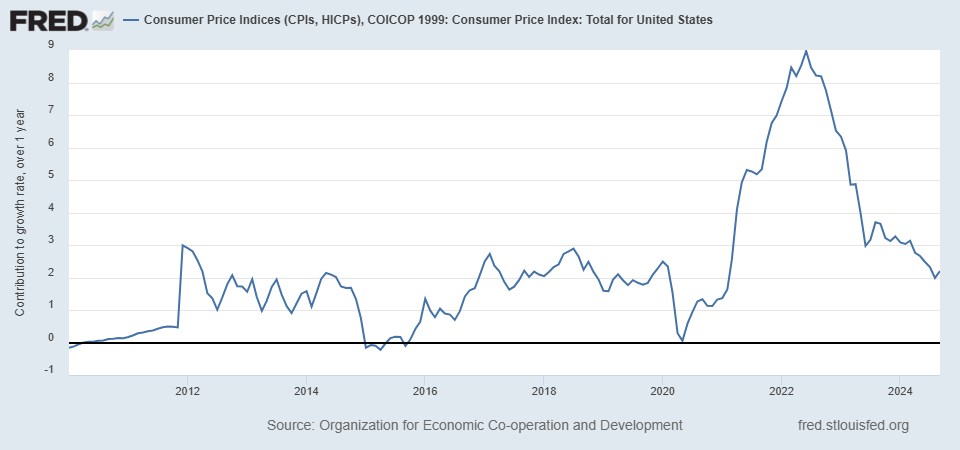

Instead, he went with the soft landing approach. He raised interest rates but still likely balanced the rate hikes so that they didn't shock employment to the levels we saw in the very early 1980s. That allowed for the economy to continue to grow but it also prolonged the length of the high-levels of inflation:

It wasn't until summer of 2023 that inflation dipped below 4% and July of THIS YEAR that it dipped below 3%.

That was the soft landing at play. Inflation dropped - even significantly - but still remained above what the healthy expectation is (around 2%) from April, 2021 (4.2%) to about August of this year when it came in 2.5%). Interestingly enough, inflation saw an uptick this past month and is back to 2.6%, so on the higher-end of what is considered 'good'.

We navigated the soft landing perfectly but the slowness of the landing created a very difficult perception for Biden and his administration to overcome. That's just reality.

BootinUp

(51,118 posts)Immaculate disinflation here in the US says you are flat wrong on the cause.

Self Esteem

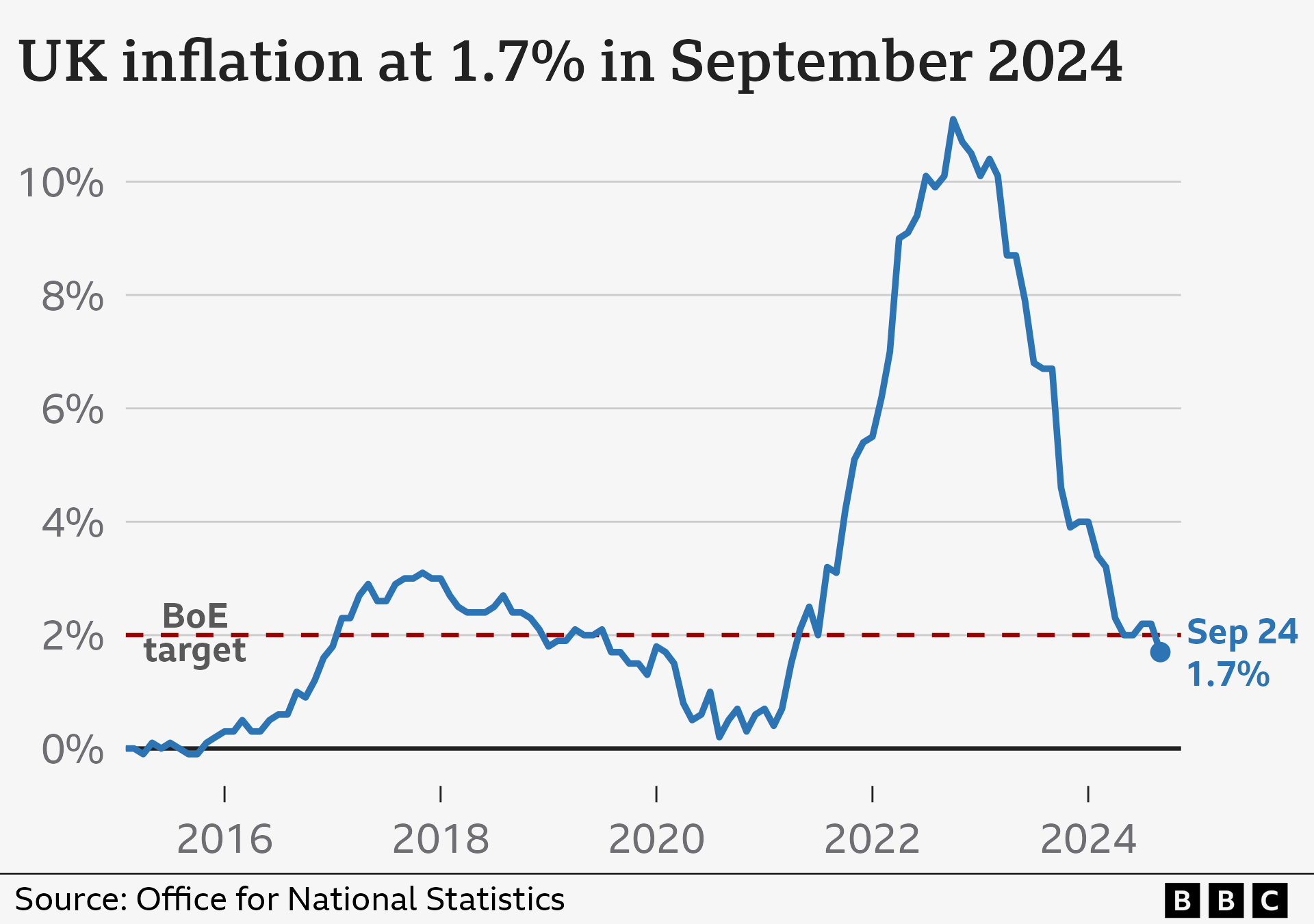

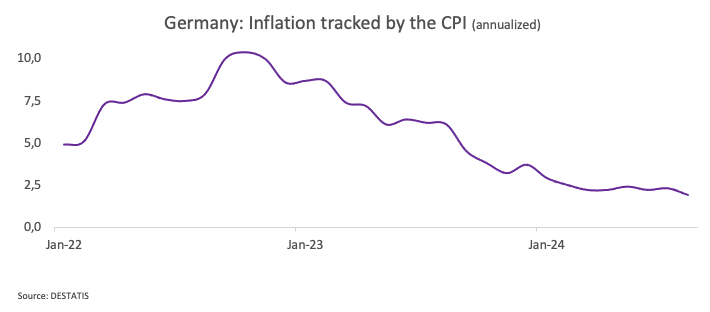

(2,248 posts)Clearly you haven't been paying attention. Inflation has dropped significantly in most the major economies.

In fact, your talking point is a year-plus old.

Here's other inflation rates (and drops) of our economic peers:

Canada (they actually have a lower inflation than the US now):

The UK (same - their inflation is lower than the US):

Germany (their inflation rate is now lower than the US):

France (again, lower than the US' now):

BootinUp

(51,118 posts)You lost me there.

BootinUp

(51,118 posts)BootinUp

(51,118 posts)we don't need to take into account how the numbers are calculated in different countries, nor do we need to consider any other factors like unemployment, GDP. Ridiculous. Where the hell do you get this progaganda from?

Self Esteem

(2,248 posts)The main post here discusses cost of living as the major issue.

And guess what? it's sunk other parties as well. It's why the conservatives lost in the UK and why Trudeau and the liberals are about to be banished in Canada.

It's also why Trump won. If inflation had never peaked at the rate it did, and lingered as long as it did, I believe not only would Biden not have dropped out, he would have won reelection.

But inflation remained heightened for far too long.

BootinUp

(51,118 posts)FBaggins

(28,695 posts)There’s no way to spin it as just a supply chain problem

BootinUp

(51,118 posts)by every other major economy suffering the same basic problem. Also in evidence is the fact it did come down without massive layoffs or a recession.

FBaggins

(28,695 posts)Inflation is always related to monetary/fiscal policy - specifically the relationship between the supply and velocity of money and the supply of goods and services. Supply issues can absolutely impact prices, but that can be mitigated by constraining money supply growth. But meeting it with incredible expansion in the money supply can only make things worse.

Perhaps inflation would have capped at 4-5% if we hadn't blown up the spending. That would still be inflation beyond reasonable targets - but 10% is so much worse.

And it is reasonable to speculate that a lower rate of inflation over those two years may have resulted in a better election night

BootinUp

(51,118 posts)BootinUp

(51,118 posts)BootinUp

(51,118 posts)"The simplest, most plausible answer is that high inflation was mainly caused by disruptions related to Covid. The pandemic caused big changes in both how we spent our money and how we worked, and it took time for the economy to adjust. These adjustment difficulties were reflected in big but temporary pressure on supply chains, as measured by an index constructed by the New York Fed, with a first bump during the depths of the pandemic — remember the great toilet paper panic? — and a more enduring problem as the pandemic subsided and spending recovered: "

"Adjustment issues were also reflected in a temporary surge in the number of unfilled job openings: "

Full article https://www.nytimes.com/2024/08/20/opinion/inflation-biden-economy.html

Self Esteem

(2,248 posts)Inflation is now lower in multiple other countries than the US currently.

BootinUp

(51,118 posts)I posted a gift link to , I am pretty sure he talks about the rent factor in our index which make a direct comparison invalid.

Self Esteem

(2,248 posts)BootinUp

(51,118 posts)Self Esteem

(2,248 posts)You're the one that said the US' drop in inflation was immaculate. I only pointed out it's something that other countries have also experienced. Every major economy has seen a significant drop in inflation. It's not just unique to the US.

BootinUp

(51,118 posts)Self Esteem

(2,248 posts)But normal range inflation doesn't mean prices automatically go down. Things are still 20+% more expensive than at this point in 2020 and it's clear voters felt that and why they decided to hand the country over to a fascist.

BootinUp

(51,118 posts)Self Esteem

(2,248 posts)BootinUp

(51,118 posts)Few graphs. I can only make quick replies. I will have to read it find it.

Self Esteem

(2,248 posts)And they spent it. That drove up inflation.

BootinUp

(51,118 posts)“ This suggests that inflation may have had less to do with overspending than it did with pandemic-related disruptions; see the article by Claudia Sahm in “Quick Hits” below. But my big question is why so many economists predicted that the rapid initial rise in inflation would be followed by protracted stagflation.”

BootinUp

(51,118 posts)Last edited Thu Nov 14, 2024, 09:39 PM - Edit history (1)

Inflation and ours that clearly show that they are all on a similar track but our inflation started coming down sooner than the other major western economies. So again, this was a global event of inflation not localized to the US spending policy.

BootinUp

(51,118 posts)Not a realistic expectation. We can play blame games with made up narratives or deal with reality as supported by the facts.

andym

(6,063 posts)andym

(6,063 posts)because the forces that drive inflation would have only been made worse by tariffs and the fundamentals would not change. My second point is that interest rates would have risen as well, given inflation, causing CC debt problems and slowing the housing market. So consumers would have faced dual harms plus whatever damage Trump did to US business with his tariff policies.

Now, Trump is going to benefit from the Fed's work on inflation, its lowering of interest rates, and the economies of the world fixing the supply problems. Things will likely keep improving (as Bill Clinton rightly stated the next President would have a good economy) UNTIL Trump starts in with tariffs and government cutbacks which will send shock waves.

Amishman

(5,924 posts)The error was not tightening soon enough once covid restrictions started to ease.

Basic macroeconomics at the heart of it, compounded by corporations attempting to grow margins and supply disruptions.

BootinUp

(51,118 posts)All the world’s major economies had the same inflationary bump without the same policy. You geniuses just can’t deal with facts.

Amishman

(5,924 posts)China

2020 M2 to 2024 M2 - 52% increase

EU

2020 M2 to 2024 M2 - 25% increase

India

2020 M2 to 2024 M2 - 60% increase

Britain

2020 M2 to 2024 M2 - 26% increase

BootinUp

(51,118 posts)Theses numbers as facts without a source link or precise description of where you got them. Secondly, if the inflation bump is not directly related in intensity to these fiscal policy changes it is still not the primary cause.

Amishman

(5,924 posts)Might not be my exact sources from before, but are within a a few percent. I had closed those tabs.

https://tradingeconomics.com/china/money-supply-m2

Jan 2020 - 202.

Current - 309

309/202 = 1.52, or 52% increase

https://tradingeconomics.com/euro-area/money-supply-m2

Jan 2020 - 12.4

Current - 15.4

15.4 / 12.4 = 1.24, or 24% increase

https://tradingeconomics.com/india/money-supply-m2

Jan 2020 - 38.4

Current - 63.1

63.1/38.4 = 1.64 or 64% increase

https://tradingeconomics.com/united-kingdom/money-supply-m2

Jan 2020 - 2.46

Current - 3.04

3.04 / 2.46 = 1.24 or 24% increase

It's basic macroeconomics, money supply increases like this - paired with static or increasing velocity of money - is intensely inflationary.

BootinUp

(51,118 posts)And they all produced an amazingly similar change in the cost of goods. The primary issue was supply disruptions. All this talk of basic economics is not important to understand that for billions of people to continue to consume during that period an inflationary spike like what resulted was unavoidable. Now leave me the bleep alone. lol.

BootinUp

(51,118 posts)That's my theory, too. I'm not overthinking the results.

In It to Win It

(12,611 posts)kentuck

(115,350 posts)Didn't VA go to Court over that?

onenote

(46,103 posts)The numbers were stark:

Biden enjoyed a relatively short honeymoon, with favorability ratings among Democrats in the 90s for most of 2021, before dropping sharply into the 80s and even 70s.

In the six-plus months of 2024 prior to his dropping out in July, Biden's approval ratings among democrats ranged between 81% and 83%. Going back to the last six months of 2023, the story was similar: 75%-87% among Democrats.

After taking over as the candidate, Harris was able to build back some favorability numbers and generate some enthusiasm. But she could never completely overcome her association with the Biden administration and it is not surprising that a significant number of blue state voters decided to sit out the election, particularly when you consider that turnout in 2020 was unprecedented and there is historical precedent for turnout dropping after a "surge" year.

BootinUp

(51,118 posts)Except what an excellent job Biden’s people did.

Think. Again.

(22,456 posts)"build back some favorability numbers and generate some enthusiasm"

Thes numbers just don't seem right.

LSparkle

(12,163 posts)I’m in CA and I cannot believe turnout was down that much from 2020. I’m afraid a lot of mail in ballots just got tossed out ...

JohnSJ

(98,883 posts)In California, the voter turnout in the November 2024 election – estimated at 71% of registered voters – is the third lowest in the last 100 years of presidential elections.

Nationwide, more than 4 million fewer people voted in the 2024 General election than in 2020, according to multiple estimates. The California Secretary of State reports that more than 1.5 million of these no-shows were in California.

The final results from 2024 are expected to show Donald Trump winning the presidency over Kamala Harris by about 2 million votes. He lost the popular vote in 2020 by nearly 7 million.

State election officials reported that 14,425,857 votes had been counted as Wednesday evening, with another estimated 1.66 million to count.

The expected final vote total in California, 16,084,660, would represent 71.2% of the state’s 22,595,659 registered voters. The number of registered voters in the state grew in this election cycle by nearly 550,000.

https://www.sanjoseinside.com/politics/voter-turnout-in-ca-among-lowest-in-a-century/

BootinUp

(51,118 posts)As per one of the maps at the link. Select turnout change map and then California.

BootinUp

(51,118 posts)To me.

FBaggins

(28,695 posts)This is only about the 200th time that someone has compared 2020 turnout to the current (incomplete) counts.

In 2020, California had just over 17 million votes for Biden/Trump (11 to 6).

There are currently just under 14 million votes counted between Harris/Trump.

That's a 17.6% decline, not 19%... but more importantly, California says that they've only counted 88% of their votes. So they anticipate the final count at just under 16 million votes.

So a 6% decline.

BootinUp

(51,118 posts)BootinUp

(51,118 posts)FBaggins

(28,695 posts)The deceptive statistic is that “turnout” is measured as a percentage of the registered population rather than the eligible adult population. And California has registered millions of people who had no intention of ever voting.

In the last twenty years or so, the population of the state has increased by a bit over 15%… but the number of registered voters has increased at almost three times that rate. So the same number of voters looks like a smaller and smaller “turnout” - but it’s entirely artificial.

The last twenty years have consistently seen 12-13 million Californians voting… then last cycle it skyrocketed to over 17 million. This year looks like it will be 15.5 million. That’s down moderately from four years ago and lower than the country as a whole… but it’s still the second best performance in the history of the state.

JohnSJ

(98,883 posts)a self-addressed stamp. California makes it so easy, and gives us so many options to vote, including on actual election day.