General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsTrump just gave away the reason for tariffs today

In meeting in Oval Office with Netanyahu

“Our country was the strongest from 1872 to 1913. You know why? All tariff based, no income tax.”

Then he continues to go on and reinforce the idea that tariffs aren’t a tax on consumers. (Question, is he actually still this misinformed about tariffs or is he intentionally lying so you won’t realize it?)

Folks, he wants to lower taxes for the rich and the only way he can do this is thru RECONCILIATION by A) Cutting entitlement programs and/or B ) increase the taxes you pay when you buy things—tariff taxes.

Raven123

(7,729 posts)AntiFascist

(13,751 posts)massive tax cuts are in store for their donors and benefactors.

OAITW r.2.0

(31,932 posts)uponit7771

(93,523 posts)Intractable

(1,909 posts)Yes. Absolutely. He knows the tariffs will hurt many people, businesses, and countries.

His goal is to wreck the world, because he thinks he will be king of the hill on top of everyone else's rubble.

LiberalLoner

(11,467 posts)And the MAGATS are all in on helping him do so, believing they will somehow be spared.

The sooner we ALL wake up to see what the plan is, the sooner we can be as brave as the members of flight 93 were.

Lovie777

(22,596 posts)Idiot.

tishaLA

(14,763 posts)when most people lacked indoor plumbing but the wealthy lived like kings. No unions or worker protections, long work hours, low wages.

But this also helps explain his desire for territorial expansion.

Demovictory9

(37,113 posts)USA is the most powerful country ever known..been that way long after 1913.

meadowlander

(5,116 posts)

Demovictory9

(37,113 posts)Kaleva

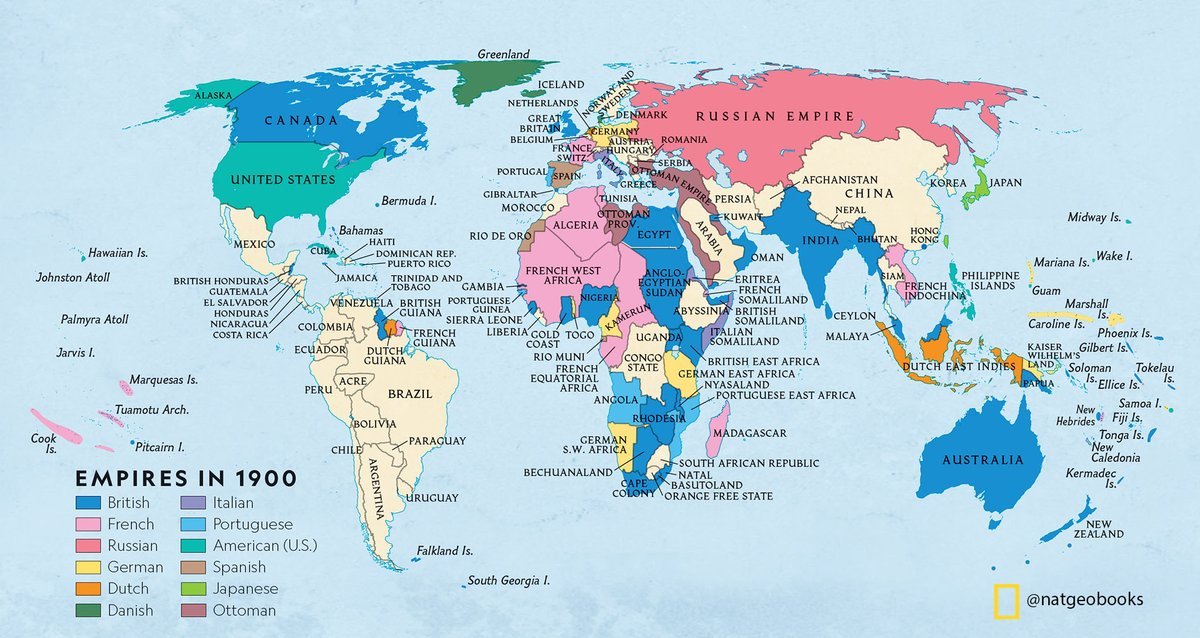

(40,307 posts)By 1900, the US surpassed GB in steel production and had close to twice the population.

A war between the two in 1900 would have resulted in GB losing all its possessions in the Western Hemisphere and possibly in the Far East.

C_U_L8R

(49,238 posts)The Financial Panic of 1873 ?

The Chinese Exclusion Act?

The Haymarket Square Riot?

The Panic of 1893?

Or maybe it was President Garfield's assassination.

newdeal2

(5,206 posts)Women and people of color were in the right place, according to him.

RazorbackExpat

(923 posts)no compensation for employees killed or injured on the job, unsanitary conditions in meat packing plants, factories belching out tons of untreated smoke and effluent, lack of indoor plumbing, rudimentary medicine...

cachukis

(3,822 posts)A lot more happens when dollars are shared. Hoarding is a psychological sickness.

Xolodno

(7,336 posts)...and paid someone to take his final. You could get away with it back then.

Cirsium

(3,797 posts)Tariffs are a tax that disproportionately impacts the working class.

Tariffs are by nature regressive and typically get worse over time: Reliance on tariffs makes taxation more ‘regressive’ and tougher on low-income and working people. In principle, as a tax on goods but not services, a tariff system taxes low-income families more heavily than wealthy households, because lower-income families spend more of their income on clothes, food, and home goods. Likewise, tariffs tax goods-intensive businesses (e.g., retail, manufacturing, construction, and farming) more than they tax investment- or service-buying industries such as real estate, law, or financial services. And in real life, 19th-century experts — say, Albert Gallatin, Treasury Secretary for the Jefferson and Madison administrations — knew by experience that the opacity of the tariff systems makes them easy for wealthy people and businesses with direct connections to government to manipulate. This means tariff systems usually grow more regressive over time, as rates fall on expensive luxuries but stay high for cheap goods whose buyers don’t know they’re paying. Again, the contemporary U.S. Harmonized Tariff Schedule illustrates the point, taxing cheap stainless steel spoons much more heavily than sterling, infant formula more than champagne, polyester shirts more than silks, and women’s clothes more than men’s.

https://www.progressivepolicy.org/tariffs-are-a-poor-form-of-taxation/

allegorical oracle

(6,380 posts)Security and don't make enough to pay taxes. They just pay more for everything they need.

marble falls

(71,557 posts)The Panic of 1873 and the subsequent depression had several underlying causes for which economic historians debate the relative importance. American inflation, rampant speculative investments (overwhelmingly in railroads), the demonetization of silver in Germany and the United States, ripples from economic dislocation in Europe resulting from the Franco-Prussian War (1870–1871), and major property losses in the Great Chicago Fire (1871) and the Great Boston Fire (1872) helped to place massive strain on bank reserves, which, in New York City, plummeted from $50 million to $17 million between September and October 1873.

The first symptoms of the crisis were financial failures in Vienna, the capital of Austria-Hungary, which spread to most of Europe and to North America by 1873.

The Depression of 1882–1885, or Recession of 1882–1885, was an economic contraction in the United States that lasted from March 1882 to May 1885, according to the National Bureau of Economic Research. Lasting 38 months, it was the third-longest recession in the NBER's chronology of business cycles since 1854. Only the Great Depression (1929–1941) and the Long Depression (1873–1879) were longer.

The Depression of 1882–1885 was not inaugurated by financial disaster or mass panic, but was rather an economic downturn that came about through a protracted and gradual process.[1] The downturn was preceded by a period of prosperity over the years 1879 to 1882, a growth powered by expansion of the American railroad industry and the opening of economic opportunities associated with the development of the transportation system.[2] During this interval annual railroad construction quadrupled, growing from 2,665 miles (4,289 km) in 1878 to 11,569 miles (18,619 km) in 1882.[2] According to one 1997 estimate, the expansion of this sector represented a full 15% of American capital formation during the decade of the 1880s.[3]

In addition, the United States experienced a favorable international balance of trade during the 1879–1882 period of growth — a fact which had the effect of expanding the country's money supply, facilitating credit and investment.[2]

Comparison of major 19th and early 20th century recessions

Downturn Length[4] Business activity[5]

1873–1879 65 mos. -33.6%

1882–1885 38 mos. -32.8%

1893–1894 17 mos. -37.3%

1907–1908 13 mos. -29.2%

1921–1922 18 mos. -38.1%

In 1882 this trend reversed, resulting in a decline in railroad construction and a decline in related industries, particularly iron and steel.[6] Mismanagement and rate wars negatively affected profitability and the luster of railroads as an investment was dulled; money dried up and construction of new lines was negatively impacted, falling from 11,569 miles in 1882 to 6,741 miles in 1883.[2]

Panic of 1884

Main article: Panic of 1884

A major economic event during the recession was the Panic of 1884.

The 1884 downturn was severe with an estimated 5% of all American factories and mines completely shuttered during the 12 months running from July 1, 1884, to July 1, 1885.[7] In addition another 5% of such enterprises were said to have closed down for part of the year.[7] Approximately 1 million American workers were out of work during this economic trough.[8]

Causes

Like the Long Depression that preceded it, the Depression of 1882–85 was more of a price depression than a production depression — in that prices and wage rates contracted while gross output remained more or less constant.[6]

Contemporary observers were baffled by the downturn and agents of the fledgling U.S. Bureau of Labor Statistics conducted extensive surveys on the matter. In a published report by Commissioner of Labor Carroll D. Wright, it was found that explanation of the 1882 depression varied greatly according to the profession of the observer, with bankers and merchants tending to blame financial or commercial reasons, members of the clergy tending to blame social causes combined with divine providence, manufacturers apt to blame regulatory causes and the wage demands of workers, and workers tending to identify overproduction due to the introduction of new labor-saving machinery and low wage levels that made it impossible to consume the full amount of output.[9]

A lengthy alphabetical list of causes claimed by survey respondents was compiled by the Bureau, which included, among other proposed factors, defects in the banking system, place of credit in agriculture, the use of child labor, the negative effects of corporate monopoly, a lack of public confidence in the future of the economy, expansion of the role of silver in the money system due to an unequal price ratio between gold and silver, excessive immigration, the expanded use of labor-saving machinery, a growth of speculative investment and market manipulation, the decline of railway construction, negative effects of a high tariff policy, and the growing consolidation of wealth in the hands of a comparative few.[10]

1887–1888 recession

1890–1891 recession

The Panic of 1893 was an economic depression in the United States. It began in February 1893 and officially ended eight months later, but the effects from it continued to be felt until 1897.[1] It was the most serious economic depression in history until the Great Depression of the 1930s. The Panic of 1893 deeply affected every sector of the economy and produced political upheaval that led to the political realignment and the presidency of William McKinley.

The pro-Republican Judge magazine blamed the Panic of 1893 on the Democratic victory in the 1892 election.

The Panic of 1893 has been traced to many causes, one of them pointing to Argentina; investment was encouraged by the Argentine agent bank, Baring Brothers. However, the 1890 wheat crop failure and a failed coup in Buenos Aires ended further investments. In addition, speculations in South African and Australian properties also collapsed. Because European investors were concerned that these problems might spread, they started a run on gold in the U.S. Treasury. Specie was considered more valuable than paper money; when people were uncertain about the future, they hoarded specie and rejected paper notes.[2][3]

During the Gilded Age of the 1870s and 1880s, the United States had experienced economic growth and expansion, but much of this expansion depended on high international commodity prices, which were also affected by the McKinley Tariff of 1890. Exacerbating the problems with international investments, wheat prices crashed in 1893.[2] In particular, the opening of numerous mines in the western United States led to an oversupply of silver, leading to significant debate as to how much of the silver should be coined into money (see below). During the 1880s, American railroads experienced what might today be called a "bubble": investors flocked to railroads, and they were greatly over-built.[4]

One of the first clear signs of trouble came on 20 February 1893,[5] twelve days before the inauguration of U.S. President Grover Cleveland, with the appointment of receivers for the Philadelphia and Reading Railroad, which had greatly overextended itself.[6] Upon taking office, Cleveland dealt directly with the Treasury crisis[7] and convinced Congress to repeal the Sherman Silver Purchase Act, which he felt was mainly responsible for the economic crisis.[8]

As concern for the state of the economy deepened, people rushed to withdraw their money from banks, and caused bank runs. The credit crunch rippled through the economy. A financial panic in London combined with a drop in continental European trade caused foreign investors to sell American stocks to obtain American funds backed by gold.[9]

The economic policies of President Benjamin Harrison have been characterized as a contributing factor to the depression.[10]

The Panic of 1896 was an acute economic depression in the United States that was less serious than other panics of the era, precipitated by a drop in silver reserves, and market concerns on the effects it would have on the gold standard. Deflation of commodities' prices drove the stock market to new lows in a trend that began to reverse only after the 1896 Klondike Gold Rush. During the panic, call money would reach 125 percent, the highest level since the Civil War.[citation needed]

The Panic of 1896 had roots in the Panic of 1893, and is seen as a continuation of that economic depression.[1] The drop in American gold reserves worsened the effects of the Panic of 1893, and the Panic of 1896 was given its own distinction. The Coinage Act of 1873 demonetized the use of silver in America, and the Resumption Act of 1875 further established the gold standard. This period of deflation was met with some resistance, as the agrarian Populist Party formed to protest the adoption of the gold standard, and reinstate the bimetallic standard, due to farmers’ inability to repay debts at lower prices, and silver miners loss of market share. Farmers also wanted to adopt the bimetallic standard because they could sell their crops at higher prices. The Sherman Silver Purchase of 1890 allowed limited use of silver in the American economy, but did not allow unlimited coinage as supporters of the "Free Silver" movement wanted. The Silver Purchase did not work as most of the backers had intended, as a large portion of the buyers redeemed their coins with gold, causing the already pressured American gold reserves to deplete. The American gold reserves dropped to just $60 million in January 1895, which, combined with the subsequent J. P. Morgan bond episode, in which Morgan, in cooperation with the European Rothschilds, sold gold directly to the U.S. treasury, causing the public’s worry for the gold standard to increase.[2]

1899–1900 recession

1902–1904 recession

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis,[1] was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs affecting banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops.[2]

The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When the bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts, leading a week later to the downfall of the Knickerbocker Trust Company, New York City's third-largest trust. The collapse of the Knickerbocker spread fear throughout the city's trusts as regional banks withdrew reserves from New York City banks. The panic then extended across the nation as vast numbers of people withdrew deposits from their regional banks, causing the 8th-largest decline in U.S. stock market history.[3]

The panic might have deepened if not for the intervention of financier J. P. Morgan,[4] who pledged large sums of his own money and convinced other New York bankers to do the same to shore up the banking system. That highlighted the limitations of the US Independent Treasury system, which managed the nation's money supply but was unable to inject sufficient liquidity back into the market. By November, the financial contagion had largely ended, only to be replaced by a further crisis due to the heavy borrowing of a large brokerage firm using the stock of Tennessee Coal, Iron and Railroad Company (TC&I) as collateral. Collapse of TC&I's stock price was averted by an emergency takeover by Morgan's U.S. Steel Corporation, a move approved by the trust-busting President Theodore Roosevelt. The following year, Senator Nelson W. Aldrich, a leading Republican, established and chaired a commission to investigate the crisis and propose future solutions, which led to the creation of the Federal Reserve System.[5][6]

Economic conditions

Dow Jones Industrial Average 1904–1910. The bottom of 53 was recorded November 15, 1907.

When United States President Andrew Jackson allowed the charter of the Second Bank of the United States to expire in 1836, the U.S. was without any sort of central bank, and the money supply in New York City fluctuated with the country's annual agricultural cycle. Each autumn money flowed out of the city as harvests were purchased and—in an effort to attract money back—interest rates were raised. Foreign investors then sent their money to New York to take advantage of the higher rates.[7] From the January 1906 Dow Jones Industrial Average high of 103, the market began a modest correction that would continue throughout the year. The April 1906 earthquake that devastated San Francisco contributed to the market instability, prompting an even greater flood of money from New York to San Francisco to aid reconstruction.[8][9] A further stress on the money supply occurred in late 1906, when the Bank of England raised its interest rates, partly in response to UK insurance companies paying out so much to US policyholders, and more funds remained in London than expected.[10] From their peak in January, stock prices declined 18% by July 1906. By late September, stocks had recovered about half of their losses.

The Panic of 1910–11 was a minor economic depression that followed the enforcement of the Sherman Antitrust Act, which regulates the competition among enterprises, trying to avoid monopolies and, generally speaking, a failure of the market itself.[1] The short-term panic lasted approximately 1 year and led to a drop of the major U.S. stock market index by ~26%. It mostly affected the stock market and business traders who were smarting from the activities of trust busters, especially with the breakup of the Standard Oil Company and the American Tobacco company.[2]

Recession of 1913–1914

applegrove

(131,575 posts)marble falls

(71,557 posts)applegrove

(131,575 posts)marble falls

(71,557 posts)applegrove

(131,575 posts)Response to marble falls (Reply #14)

applegrove This message was self-deleted by its author.

Doodley

(11,832 posts)Last edited Tue Apr 8, 2025, 08:06 AM - Edit history (1)

idiot in front of Netanyahu.

the nelm

(261 posts)And either he is too stupid too still not get it, or he is actually this evil. (Or some combination of both?) No one can tell him anything differently once he gets a dumb idea in his head - he just isn't capable of learning an eff'in thing or, worse, ever being able to admit that he's wrong about anything. It's more of that "I'm smarter than everyone else in the room", "I am legend" grandiosity of his. He's always been that way. Others suggest that there is some sort "genius" at work in his motives, but, to me, he really is just that stupid.

Doodley

(11,832 posts)You are right, there is no genius, only stupidity.

Justice matters.

(9,650 posts)"attack, attack, attack"

"never take any responsibility"

Those three ass-holery from... the other moron.

Doodley

(11,832 posts)Tickle

(4,131 posts)pay income tax to. Right

NutmegYankee

(16,476 posts)C_U_L8R

(49,238 posts)Sorry Donnie, you can't go back in time in some lame fantasy that people might respect you more. A fool is a fool, no matter what era.

Meowmee

(9,212 posts)The economy from the time he mentioned was very different than now it was mostly agricultural. You had a much lower population, and it wasn’t all tariffs…once again displaying ignorance of history and the facts. I think there also wasn’t as much trade internationally.

Yo_Mama_Been_Loggin

(134,609 posts)What saved us those days was our isolation. The European nations were a lot more powerful militarily.

We didn't become the preeminent world power till after WWII largely due to the fact our infrastructure was still intact.

CitizenZero

(920 posts)Tariffs are taxes on consumers. They are regressive and hit the working class and the middle class hardest. So Trump is going to kill the progressive income tax with a regressive tariff tax on working people. Add to this the massive cuts to welfare programs like Medicaid and SNAP. Then cut the income taxes for the super wealthy. And abscond with all of the tariff money that he makes on the backs of the working class. A massive government based white collar crime. Theft on a grand scale.

Lonestarblue

(13,404 posts)Trump wants the US to return to the days of robber barons who essentially used their money to control the government. He conveniently ignores that a worldwide Great Depression caused in the US followed his favorite time period—and for many of the reasons we’re seeing today’s , especially with the crypto speculation pulling in unsophisticated investors who think they get get rich quickly.

JHB

(38,120 posts)Last edited Mon Apr 7, 2025, 11:00 PM - Edit history (1)

As far as they're concerned, the Gilded Age, the age of the Robber Barons, was the pinnacle of American Civilization. They're aristocrats that think only a certain sort of people (in which they definitely include themselves) should be running things, and we spent the entire 20th century undermining that fundamental formula for greatness by being soft and giving the rabble too much of a say in things.

It ain't just Trump. He has entire bands of the equivalent of Bolsheviks counting on him to help them grab all the marbles.

Klarkashton

(5,114 posts)It was the simplest answer to this shit.

VMA131Marine

(5,242 posts)Trump’s grandfather back to the US. But for that, would the Trump family have survived WWI? WWII?

Deporting people can have unintended consequences.

EnergizedLib

(3,003 posts)I’ve never known tariffs to be a reason why.

Mr.Bee

(1,773 posts)We've seen this movie before. One man, on a personal mission to relive his unrequited glory from the past and drag the whole country, if not the world, along with him.

'I've worked out a very simple plan. First we collect every key on this ship and tag it with the name of the owner. Second, we strip all hands to make sure we've got all the keys. Third we test each key on the ice box padlock.'

'It's a re-enactment of a crowning moment from Queeg's past when as a young ensign he received a commendation for uncovering a petty theft on his ship.'

When will we ever give Trump a psychiatric evaluation?

Then again, Captain Queeg didn't 'look' insane...

Nululu

(1,116 posts)Extortion opportunities from countries

surfered

(12,810 posts)While I am no fan of many of the free trade deals, these Trump tariffs aren’t thought out at all and are just destructive. Plus, as you said, the working class is not on his mind at all. He wants power over corporations who won’t want to challenge him - and yes, would enrich his rich buddies by changing the whole tax structure.

Martin Eden

(15,520 posts)Corporations will lobby for relief, and will comply with his demads on bended knee. Tariffs are a means of coercion, just as he has pressured universities and law firms.

The Felon plans to remain in office as long as he wants. He's itching to invoke the Insurrection Act and declare martial law.

As protests grow, Proud Boys and their ilk will incite violence. The Felon will do what he wanted to do during the George Floyd protests -- use the military to shoot protesters.

Do not underestimate what The Felon will do, or try to do. The scenario in the previous paragraph could be orchestrated in the run-up to the 2026 midterm elections, which would then be canceled or controlled with the iron fist of a dictator and his Republican cohorts who are equally determined not to lose their House and Senate majorities.

They have already shown an utter disregard for American institutions, our Constitutional rule of law, and truth.

Do you really think that once they've thrown their lot in with a dictator-- which they have already done -- that there is a line they will not cross?

I'm not saying they will succeed.

I'm saying they must be stopped.

AntiFascist

(13,751 posts)Justice matters.

(9,650 posts)Nothing guarantees "nobody" will not get shot back at...