California

Related: About this forumState Farm to stop accepting homeowners insurance applications in California due to wildfires

Published Sat, May 27 20232:52 PM EDT

Ashley Capoot

@ashleycapoot

State Farm General Insurance Company on Friday announced that it will stop accepting new homeowners insurance applications in California, citing “rapidly growing” catastrophe risks like wildfires, “historic increases” in construction costs and a challenging reinsurance market.

“We take seriously our responsibility to manage risk,” the company said in a release.

State Farm said it will stop accepting new business, personal lines property and casualty insurance applications starting Saturday. The new policy will not impact personal auto insurance, according to the release. State Farm’s independent contractor agents will also continue to serve existing customers.

The company said it will work with the California Department of Insurance and other policymakers to improve conditions in California, but that State Farm decided to take action to improve its “financial strength.

(snip)

https://www.cnbc.com/2023/05/27/state-farm-to-stop-accepting-homeowners-insurance-applications-in-california.html

I don't normally post in here but saw this article that got buried over a holiday weekend (and probably wouldn't pass muster in LBN).

underpants

(186,743 posts)TexasDem69

(2,317 posts)Not least of which that housing costs are astronomically high.

brewens

(15,359 posts)homes burnt out except for the one guy that built his place right. There was a little bit of a stink raised because the fire department focused their efforts on saving that guys home if I remember right. It was the only one they even had a chance at saving and the guys were hosing it down from the street above ready to run for it.

Then from the same fire I saw this jackass that admitted to having a shake shingle roof. No problem, and he was going to rebuild. He didn't say if he would be a little more careful.

Lack of regulation in the first place and insurance companies willing to ensure guys like that to take the big money when they could.

PlutosHeart

(1,445 posts)sinking properties? I am tired of paying for their rebuilds.

More_Cowbell

(2,204 posts)So many people want water views and keep getting reimbursed by insurance to build there again.

The Mouth

(3,286 posts)and has for centuries, why should you expect anyone to insure it?

Here in Santa Rosa, they approved housing in an area that had burned heavily twice before (Fountaingrove). But the last time, in 1964, it was mostly just oak and shrubs.

And they let people rebuild! Out of the same materials.

We have 20 million too many people here in CA, and at least 200K too many in Sonoma County.

BumRushDaShow

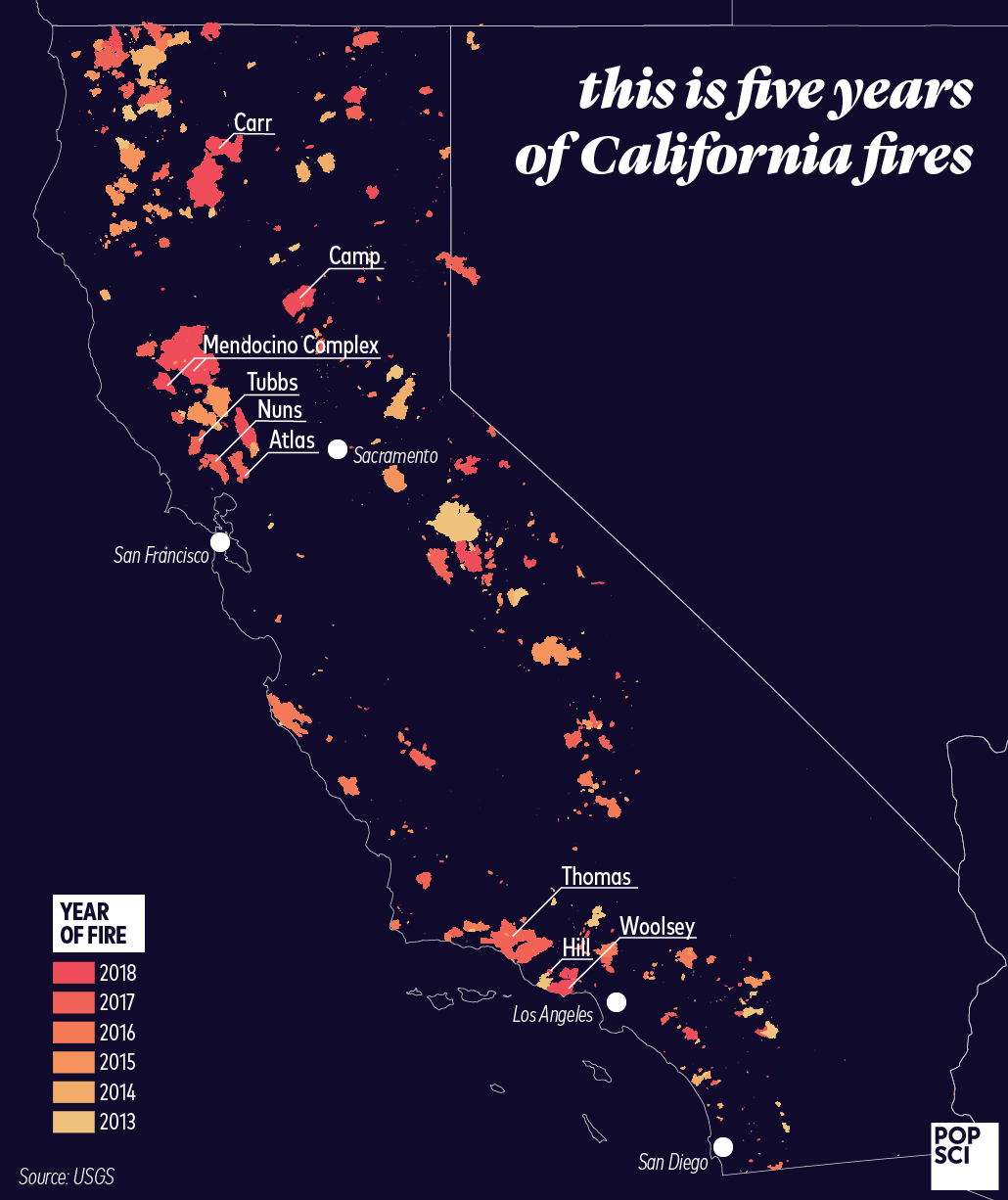

(142,600 posts)I would think, like they do with creating (and periodically updating) the flood zone maps, that there would be areas designated as chronic "burn areas" (for the most part, because like the flood zones, there are places that might periodically flood but mainly due to one-off events), so that the rest of the state doesn't get impacted by a lack of insurers.

E.g., - the below from 2013 - 2018 - https://www.popsci.com/california-five-year-wildfire/

Alternately, like flood insurance, which is now only offered by the federal government, there could be similar for wildfires offered by the federal government (in the event that more or even all the insurers pull out).