Economy

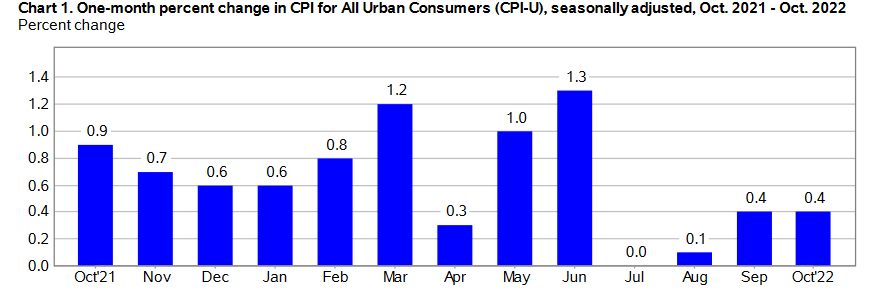

Related: About this forumInflation cooling: last 4 months: CPI: 2.8%, Core CPI: 5.3%, PPI: 0.06%, Core PPI: 2.5% (annualized)

Last edited Wed Nov 16, 2022, 03:52 PM - Edit history (2)

The title line are the last 4 months (October over June) AT AN ANNUAL RATE.

I know I know, you won't find this in the media anywhere. They are fundamentally incapable of reporting anything besides the one month change and the twelve month change. They are fundamentally incapable of understanding that maybe the first several months of a 12 month period are ancient history. And yes, they are fundamentally incapable of calculating inflation rates from the data.

Note also the PPI generally leads the CPI. So that the PPI is 0.06% and Core PPI is 2.5% is a good harbinger for the next CPI report in about a month from now.

CPI https://data.bls.gov/timeseries/CUSR0000SA0

Core CPI http://data.bls.gov/timeseries/CUSR0000SA0L1E

PPI http://data.bls.gov/timeseries/WPSFD4

Core PPI http://data.bls.gov/timeseries/WPSFD49116

CPI = Consumer Price Index,

PPI = Producer Price Index aka wholesale prices

The Core CPI is the CPI less food and energy

The Core PPI is the PPI less food, energy, and trade services

How the 4 month inflation figures were calculated:

https://www.democraticunderground.com/?com=view_post&forum=1002&pid=17358410

===============================================

The markets are noticing too -- interest rates are dropping. The 10 year Treasury was 4.2% on November 8, now at 3.7%. That's a lot of drop in one week.

{#} Treasury Interest Rates

10 Year Treasury - Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis (DGS10) (FRED)

https://fred.stlouisfed.org/series/DGS10

US Treasury Yield Curve (you can set the date)

https://www.ustreasuryyieldcurve.com/

Select interest rates -- scroll to the Treasury section

https://www.federalreserve.gov/releases/h15/

10-year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity (FRED)

(This has gone negative before every recession. But not every negative occurance has preceded a recession. If I got that right)

https://fred.stlouisfed.org/series/T10Y2Y

Latest quote and recent history graphs of individual treasuries

1mo Treasury https://www.cnbc.com/quotes/US1m

3mo Treasury https://www.cnbc.com/quotes/US3m

2Y Treasury https://www.cnbc.com/quotes/US2Y

5Y Treasury https://www.cnbc.com/quotes/US5Y

10Y Treasury https://www.cnbc.com/quotes/US10Y

20Y Treasury https://www.cnbc.com/quotes/US20y

30Y Treasury https://www.cnbc.com/quotes/US30y

Yahoo Finance symbols for Treasury yields : 3mo: ^IRX, 5y: ^FVX, 10y: ^TNX, 30y: ^TYX (None for 2y)

https://finance.yahoo.com

doc03

(36,705 posts)economists are predicting inflation will be worse in 20 23 and the other from Goldman Sachs predicting

an inflation rate of I think 2.8% at the end of 2023. My IRA has gained several thousand dollars in the last couple weeks.

It doesn't appear Wall Street is expecting any deep recession next year either.

![]()

Starfury

(822 posts)Graph from another site visualizing BLS inflation data for the last 12 months: