Economy

Related: About this forumSTOCK MARKET WATCH: Thursday, 16 May 2024

STOCK MARKET WATCH: Thursday, 16 May 2024

Previous SMW:

SMW for 15 May 2024

AT THE CLOSING BELL ON 15 May 2024

Dow Jones 39,908.00 +349.89 (0.88%)

S&P 500 5,308.15 +61.47 (1.17%)

Nasdaq 16,742.39 +231.21 (1.40%)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Market Conditions During Trading Hours:

Google Finance

MarketWatch

Bloomberg

Stocktwits

(click on links for latest updates)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Currencies:

(Awaiting new links)

Gold & Silver:

(Awaiting new links)

Petroleum:

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DU Economics Group Contributor Megathreads:

Progree's Economic Statistics (with links!)

mahatmakanejeeves' Rail Safety Megathread

mahatmakanejeeves' Oil Train Safety Megathread

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Quote for the Day:

The president’s thoughts were frenetic. It’s a disconcerting experience to attempt a conversation with him because he talks the whole time. He asks questions but then immediately starts to say something else. Almost everything he says he subsequently rephrases two or three times, as if he’s stuck in some holding pattern waiting for an impulse to arrive that kicks off the next thing he wants to say. It all adds up to a bizarre encounter.

Andrew G. McCabe. The Threat: How the FBI Protects America in the Age of Terror and Trump. St. Martin's Press. © 2019.

This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.

bucolic_frolic

(46,995 posts)A sample of random YouTube channels:

"All-in risk on!" Market pattern overlays show this movie before, and it's hundreds of percents higher from here over the next 4 years.

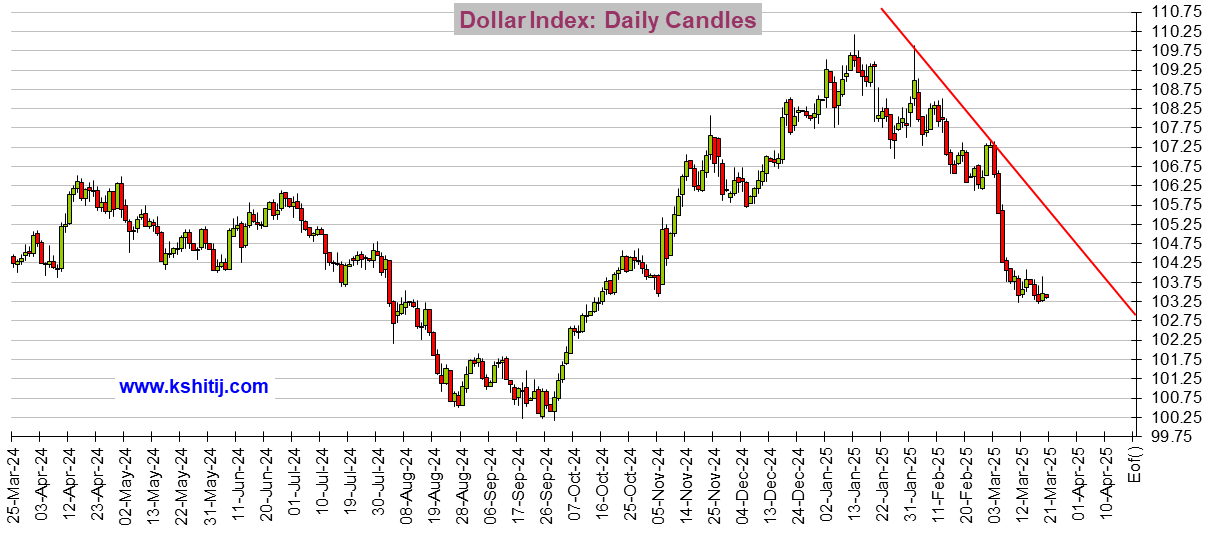

Dollar may crash. Bitcoin breaking out. 69,000 or thereabouts would be a new high.

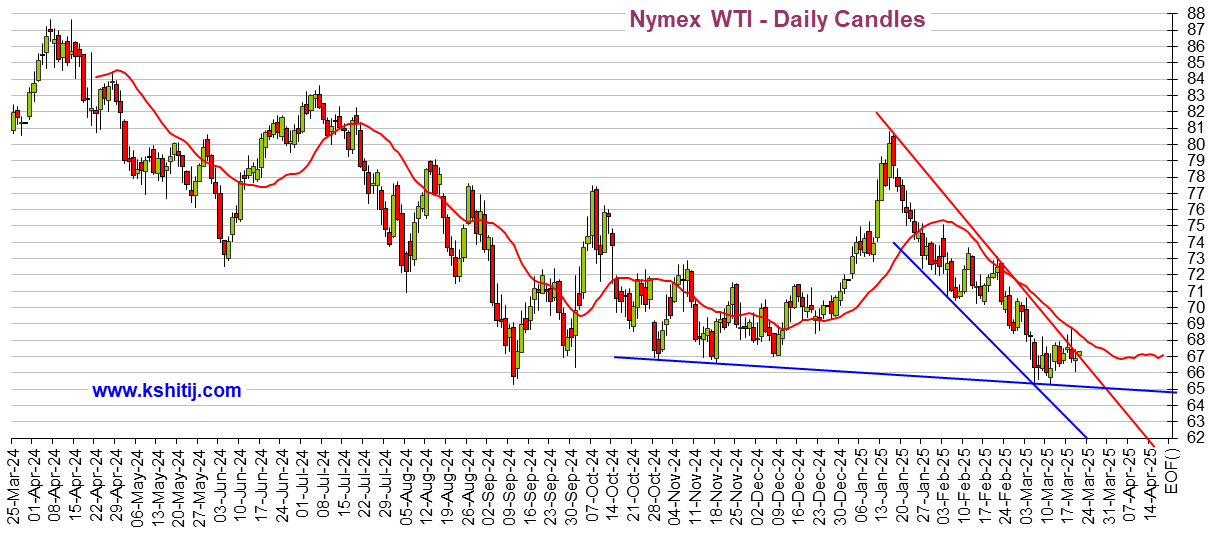

Oil headed lower.

It was a trending day, if not in early there were no clear entry points. SCHG ETF up more than 1.5% on the day.

Some are worried about the banks. 6 banks have failed in the last 2 years, just like 2007-8. The money supply is very constrained, more so than any time since 1981. Pandemic STIM created inflation, the Fed is mopping it up. Real estate, multi-unit residential and commercial is contracting as rent resistance increases. Banks may be left with those loan defaults.

Tansy_Gold

(18,054 posts). . . . . lead to interesting times?

bucolic_frolic

(46,995 posts)Until then I have to take this stuff seriously. ![]()

progree

(11,463 posts)Last edited Wed May 15, 2024, 08:17 PM - Edit history (2)

and it's only 10.7% higher than that, a rather weak rise for 2 1/3 years, just a 4.5%/year average annual increase since then. So we're not in some kind of nosebleed territory.

In terms or purchasing power (i.e. after adjusting for inflation), it's in slightly negative territory.

(The Jan 3, 2022 all-time closing high of 4797 remained unbroken until January 19 of this year. And still remains unbroken when adjusted for inflation)

Historically, broad market averages like the S&P 500 spend most of their time at or within 7% of their all-time highs [1], often setting new highs, so setting new all-time highs is not anything particularly noteworthy or scary.

What's scary is how much bond prices have fallen, both in nominal dollars and far worse in inflation-adjusted dollars. It's supposedly the safe alternative that steadies a mixed equity-fixed income portfolio, but it's been anything but in the last 3 years.

And how much the purchasing power of my annuity's fixed income stream has fallen in the last 3 years (nearly 18%). Annuities are supposedly the safest of them all.

[1] Since 1956, the S&P 500 has spent 27.5% of its time within 2% of an all-time high, 44.1% within 5% of an all-time high, 51.5% within 7% of an all-time high, and 59.6% within 10% of an all-time high.

https://www.bespokepremium.com/interactive/posts/think-big-blog/sp-500-percent-of-time-at-new-highs

Edited to add footnote 1.