Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumSTOCK MARKET WATCH: Wednesday, 17 July 2024

STOCK MARKET WATCH: Wednesday, 17 July 2024

Previous SMW:

SMW for 16 July 2024

AT THE CLOSING BELL ON 16 July 2024

Dow Jones 40,954.48 +742.76 (1.85%)

S&P 500 5,667.20 +35.98 (0.64%)

Nasdaq 18,509.34 +36.77 (0.20%)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Market Conditions During Trading Hours:

Google Finance

MarketWatch

Bloomberg

Stocktwits

(click on links for latest updates)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Currencies:

(Awaiting new links)

Gold & Silver:

(Awaiting new links)

Petroleum:

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DU Economics Group Contributor Megathreads:

Progree's Economic Statistics (with links!)

mahatmakanejeeves' Rail Safety Megathread

mahatmakanejeeves' Oil Train Safety Megathread

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Quote for the Day:

Both Marx and Engels acknowledged that women’s labor—in producing the labor force itself (reproduction) and in maintaining it (housewifery and motherhood)—was the underpinning of all economic activity. Having noted that, they went on to ignore it and to concentrate all hope in their narrowly defined “labor force”—for which read men. Had they done otherwise, they would have wound up with a very different vision of the proletariat.

Robin Morgan. The Demon Lover: The Roots of Terrorism. Washington Square Books / Pocket Books. © 1989, 2001.

This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.

2 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

STOCK MARKET WATCH: Wednesday, 17 July 2024 (Original Post)

Tansy_Gold

Jul 2024

OP

Warpy

(114,467 posts)1. Your quote

I read in more than one place that Russian women used to remark wryly that the revolution freed them to do twice as much work.

And of course, half that work never figured in to pension allocation or anything else.

The only group radical enough to recognize and try to organize women's work inside the home were the Wobblies.

progree

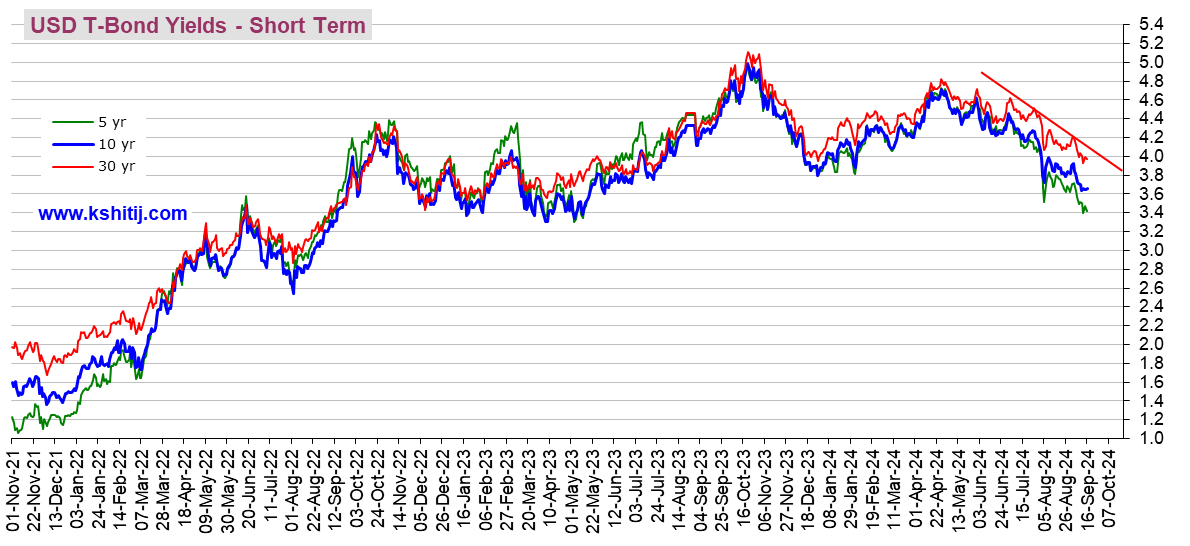

(12,788 posts)2. Treasury bond yields since November 2021. And intermediate bond values have declined substantially in purchasing power

I had hoped to find a 6 month graph like the graphs in the OP, but oh well. This is a 2 2/3 year one.

The peak point on the 10 year Treasury bond (dark blue), which is my focus, is October 2023 at very near 5.0%

Then there is good news on inflation in the last quarter of 2023 and yields go down -- it goes down to about 3.8%, then rises (on bad news about inflation in the first quarter of 2024) up to a 2nd peak of about 4.7% in late April. The good May and June inflation reports that came out mid-June and mid-July respectively caused it to go back down to around 4.2% where it is now. (Admittedly, I don't see any good inflation reports that were available in late April or May that would have started yields downward).

When the yield goes down, my intermediate term bond funds go up in value. And the opposite when yields go up.

One that I monitor went up 13% in value from October 2023 to late December (but still at an overall loss). Just goes to show how bonds can swing quite widely in value in a short time. And then back down again.

Picking one, VCOBX, it's down 7.3% since November 2021 (the beginning of the graph). That's total return, including reinvested dividends.

https://www.morningstar.com/funds/xnas/vcobx/chart

That's in nominal ordinary dollars. Meanwhile prices have gone up 12.3% since November 2021, according to the CPI

https://data.bls.gov/timeseries/CUSR0000SA0

So its inflation adjusted return is about -17.4%. Meaning for every basket of goods it could buy in November 2021, it can buy only 0.826 baskets of goods now.

We old people are told to have at least 40% in fixed income because such are supposedly steady investments. Sigh.

https://kshitij.com/graph-gallery/bond/usd-yields-Short-Term

The other reason to watch yields is that mortgage rates and auto loan rates tend to follow.

And to see how much credence and weighting the market is putting to the various inflation reports and how much more or less likely the Fed is to cut interest rates in the not-too-distant future.