Economy

Related: About this forumSTOCK MARKET WATCH: Monday, 5 August 2024

STOCK MARKET WATCH: Monday, 5 August 2024

Previous SMW:

SMW for 2 August 2024

AT THE CLOSING BELL ON 2 August 2024

Dow Jones 39,737.26 -610.71 (1.51%)

S&P 500 5,346.56 -100.12 (1.84)

Nasdaq 16,776.16 -417.98 (2.43%)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Market Conditions During Trading Hours:

Google Finance

MarketWatch

Bloomberg

Stocktwits

(click on links for latest updates)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Currencies:

(Awaiting new links)

Gold & Silver:

(Awaiting new links)

Petroleum:

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DU Economics Group Contributor Megathreads:

Progree's Economic Statistics (with links!)

mahatmakanejeeves' Rail Safety Megathread

mahatmakanejeeves' Oil Train Safety Megathread

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Quote for the Day:

I am aware of an obvious inference: from every quarter have I heard exclamations against masculine women; but where are they to be found? If, by this appellation, men mean to inveigh against their ardour in hunting, shooting, and gaming, I shall most cordially join in the cry; but if it be, against the imitation of manly virtues, or, more properly speaking, the attainment of those talents and virtues, the exercise of which ennobles the human character, and which raise females in the scale of animal being, when they are comprehensively termed mankind—all those who view them with a philosophical eye must, I should think, wish with me, that they may every day grow more and more masculine.

Mary Wollstonecraft. A Vindication of the Rights of Woman: With Strictures on Political and Moral Subjects. William Gibbons © 1792.

This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.

bucolic_frolic

(54,359 posts)cliffside

(1,612 posts)progree

(12,785 posts)

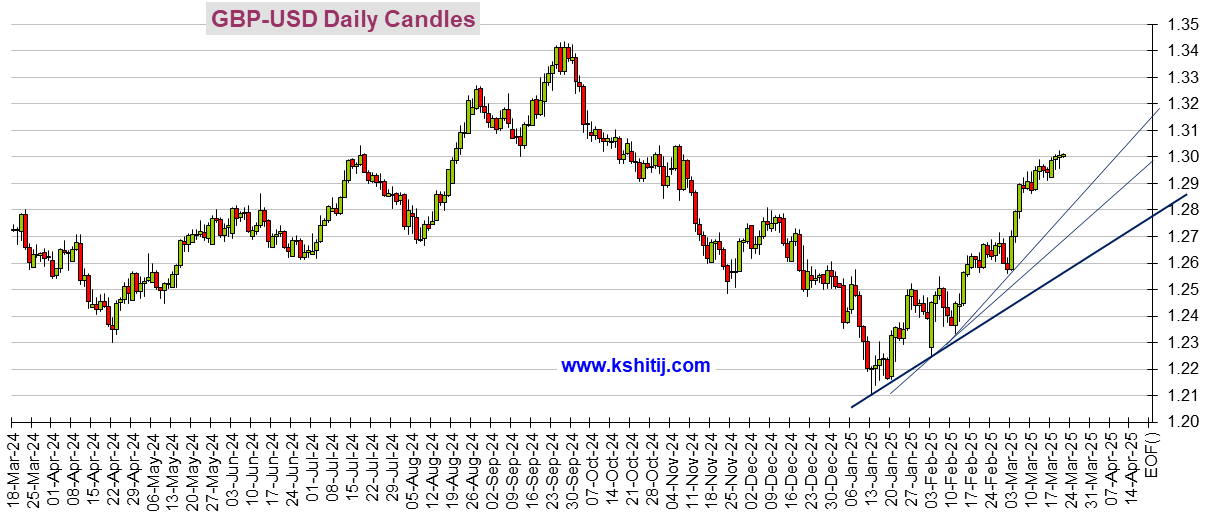

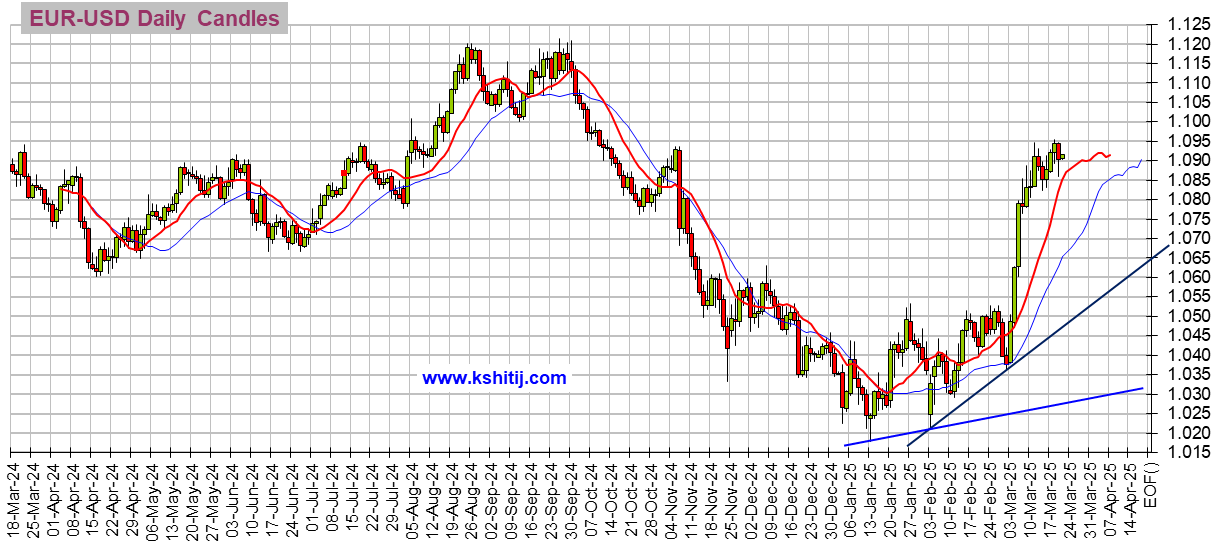

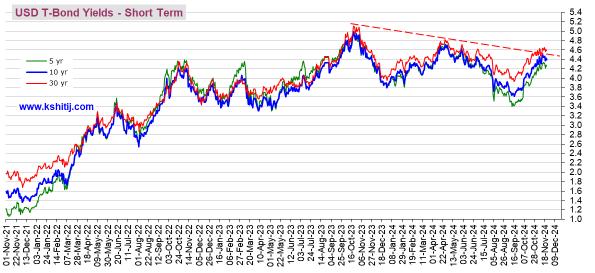

I wish they had a 6-month time frames like the other kshitij.com graphs, for easy comparison and to zoom on more recent, but they don't.

Anyway it looks like the 10 year yield was almost 5% last October and 4.7% in early May, now its 3.8%.

Good for my intermediate term bond funds (when yields go down, their value goes up), but they are still way down from 3 years ago, and down even more in purchasing power because of inflation.

About the DOW graph - I saw a headline yesterday, "When bad news is bad news again", referring to the bad jobs report causing the Friday stock market plunge.

In the last few years one never knew - a bad economic report often resulted in a good stock market day on hopes that increased the odds of a rate cut. But this time around everyone is blathering about a recession around the corner.

I read a commentary on the Jobs report from The Street about how woefully bad it was. Interestingly they mentioned that the Atlanta Fed's GDPNow estimates next quarter's GDP at 2.5%.

I can't think of many recessions with back to back quarters of 1.6%, 2.8%, 2.5% (Q1, Q2, and projected Q3),

I always thought the informal definition of recession was two back to back NEGATIVE GDP growth numbers. And while the NBER (nber.org), the official arbiter of when recessions and expansions occurs doesn't use that definition, just about every time I think they have called a recession, that's been true - at least 2 negative back-to-back quarters.

https://ycharts.com/indicators/us_real_gdp_growth

And they didn't call Q1 2022 (-2.00%), Q2 2022 (-0.6%) a recession even though both quarters were negative. So even 2 back-to-back negative quarters is not always enough. But +1.6%, +2.8%, +2.5% oughtta do the trick I guess. (Maybe they are secretly warning Powell about the unfolding disaster).

And 4.3% unemployment rate -- almost all my (long, sigh) adult life, 4.3% was seen as a super-duper number to aspire to. Now, I guess we're supposed to post about how bad it is.

cliffside

(1,612 posts)of the 10 year yield.

https://www.tradingview.com/x/yI1YRpVi/

And going back to 1963 with 6 month candles.

https://www.tradingview.com/x/TasPb1rx/

progree

(12,785 posts)charts:

cliffside

(1,612 posts)progree

(12,785 posts)Stocks trampled in stampede from risk, bonds eye rapid rate cuts. AP, 8/5/24 1235 AM ET

https://www.msn.com/en-us/money/markets/japan-s-nikkei-225-stock-index-sinks-nearly-13-as-investors-dump-a-wide-range-of-shares/ar-AA1oeJbk

https://finance.yahoo.com/

Ticker at top at far right, currently 31,458, down 12.4%

Closed Wednesday 7/31/24 at 39,102

so "current" 31,458 is down 19.5% from that

July 11 close was 42,224

so "current" 31,458 is down 25.5% from that

so definitely a bear market for them.

https://finance.yahoo.com/quote/%5EN225/history/

==========================================

Asian stocks tumble on recession fears; Japanese shares eye bear market

3 hours ago so 8/4 1107pm ET

https://www.msn.com/en-us/money/markets/asian-stocks-tumble-on-recession-fears-japanese-shares-eye-bear-market/ar-AA1oeFTs

Stocks trampled in stampede from risk, bonds eye rapid rate cuts, 138 AM ET 8/5/24

https://www.msn.com/en-us/money/markets/stocks-trampled-in-stampede-from-risk-bonds-eye-rapid-rate-cuts/ar-AA1oeXux