The Social Security retirement age: Who’s really living longer?

>>>

But now some conservative thought-leaders and wealthy CEOs are again championing lifting the retirement age, this time to 70. Their argument probably sounds familiar to anyone who remembers the 1983 reforms: as people live longer, the retirement age should adjust upward. It sounds reasonable to people who have white collar jobs working in air-conditioned offices – but for millions of working Americans, the reality is much different.

>

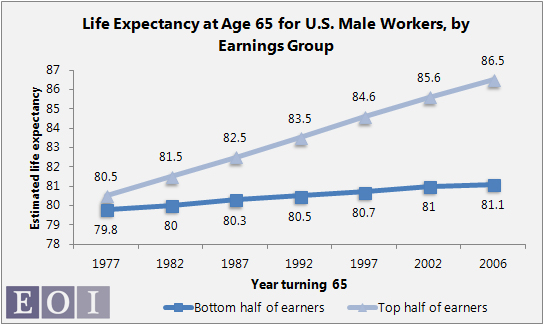

A Social Security Administration study found income inequality plays a big role in life expectancy. For workers in the top half of the earnings distribution, average life expectancy is 86.5, but for those in the bottom half it’s just 81 — a gap of more than 5 years that continues to grow.

>>>

?w=610

?w=610

http://washingtonpolicywatch.org/2013/03/20/the-social-security-retirement-age-whos-really-living-longer/

customerserviceguy

(25,185 posts)is a sliding scale of retirement ages. It wouldn't be that difficult to use worker's comp records to figure out which 20% of the jobs are the most physically stressful, and every fifth after that.

Let the workers in that toughest 20% retire with full benefits at 65, and have the retirement age for full benefits be 69 for the last quintile, with the other three in between. Peg the Medicare age to the Social Security retirement age, and you'll have a symmetry.

As we evolve from a society of difficult jobs into service-economy workers who have much less stress than the folks who were the original retirees at the dawn of Social Security, we raise the average retirement age gradually and equitably. Pencil-pushers like me always have extra ways and means of shoving a bit more into our retirement accounts than hotel maids and dock workers.

ProgressiveProfessor

(22,144 posts)customerserviceguy

(25,185 posts)Would they be perfect? Probably not, but I cannot imagine a job being misclassified by more than one year from using those records.

JDPriestly

(57,936 posts)motions syndrome problems. They can't work that long either.

Generally, non-management jobs are very stressful. The less control you have, the more stress you have.

customerserviceguy

(25,185 posts)it will show up in worker's comp statistics, won't it?

By the time an office worker gets to be in their sixties, they've either figured out how to deal with their job stresses, or they haven't, and they figured that out some years ago, and figured out an early escape plan.

Of course, the alternative is keeping the present system, which treats all workers exactly alike, and makes them wait until 67, no matter what. Usually, it's the white-collar types who have managed to take advantage of ways to save for retirement so they can bail out at 62. I still favor keeping that option.

JDPriestly

(57,936 posts)That's because a lot of the problems do not become unbearable until a person is in their late 60s or 70s and starts to fall.

Why do you think so many women have hip and back problems? Bearing and carrying babies and children are also a problem for women who do not move heavy machinery or other objects.

Clearly, truck drivers and farmers have more physical damage earlier, but if you have done desk work for 35-40 years, even if you have exercised, you have probably used your muscles in a way that has caused some of them to deteriorate and others to become way too strong. In addition to simply demanding too much of our muscles and bones, it's flexing the same muscle over and over in one direction and not stretching it in the other that causes so many injuries. Movement has to flow and be balanced by countermovement. Debilitating strain can result from small movements as well as from large ones.

customerserviceguy

(25,185 posts)Nursing, for instance? Maybe there's a better way to figure out which jobs are more physically stressful than others, but the basic premise of my idea is that there are differences between jobs, not all workers are stressed equally, and that we can restore equity to those at the most difficult end of the scale by allowing them to retire with full benefits at 65 by having others wait until 69. Also, as we get into a society that does less and less physical work over the decades, we naturally can transition the retirement age to something more realistic than 67.

JDPriestly

(57,936 posts)Sorry, but I'm over 65. Modern medicine keeps you alive, but it doesn't keep you fit and healthy enough for most jobs.

Even if you exercise and eat right, you still age. Bosses don't like older employees. The average senior is slower. Pretty universally, it can be said that our recall slows even if it remains intact. In addition, we don't have the same physical reaction time that we hand when we were younger. Employers really don't like having to deal with those factors.

Right now, employers are busily firing people in their 50s. And once a person in their 50s loses a job, it's hard for them to get another one. Many people in their 50s work part-time.

As time passes and technology advances, there will be even less demand for workers, especially older workers, than there is today. We have to figure out a way to accommodate an increased number of retirees.

People will live long, but not efficiently. Raising the retirement age will not work. I had planned to work to 70. I even went back to school and retrained so I could. That was my plan. Employers had a different one.

customerserviceguy

(25,185 posts)What I'm seeking by my suggestion is a way to have some folks return to 65 or 66 as the full benefits retirement age, by looking at the disparity within jobs. The icing on the cake for the opposition is that the average age would move slowly upwards as we became a more technologically advanced society.

Nothing else could happen to undo the mid-1980's 'repairs' that produced the current 67 rule. We're simply not going to lower the age of collecting full benefits for anybody with the crisis the Social Security System is presently in.

I'm in agreement with you as to what employers want to do, but they're going to do that with the over-50's anyway, if that is what they want to do. Some employers recognize that people outside their child-raising years have more time to devote to the job, and they'll retain their more experienced workers.

PETRUS

(3,678 posts)"this practice of creating "hardship exemptions" was one of the policies that won Greece much ridicule in recent years. Its social security system allowed workers in many occupations to retire at younger ages. For example hairdressers were allowed to start collecting benefits at age 50, ostensibly because they worked with hazardous chemicals."

customerserviceguy

(25,185 posts)All I'm advocating is that those who do the most physically stressful work should be allowed full benefits at 65, as it was for years, and that we pay for that by not allowing full benefits for those who do not have physically demanding jobs, who can do them for more years. As we transistion to a society where the burdens of work get lighter because of technology, we naturally raise the retirement age.

We don't live in the world of 1935 when the Social Security rules were first put in place, we live in a place where people live longer and more productive lives, where backbreaking labor is the exception rather than the norm. Shouldn't our policies for retirement plans reflect that just a little bit?

PETRUS

(3,678 posts)Output per worker has increased substantially; we are a much wealthier nation than we were in the '30s and can afford more generous public pensions and more leisure time (this could mean earlier retirement). Your idea is simply unnecessary - not to mention it would increase administrative costs which could consume much of the "savings" - and introduces further divisions in our society, which I regard as undesirable in general and tends to undermine support for universal public programs.

customerserviceguy

(25,185 posts)from the 1950's to the 1970's, and the rise in the cost of resources has taken much of it back.

Just how much would it cost to group jobs in five quintiles? Most basic types of work could be easily quantified, and a number assigned that would stick with the job. It wouldn't be too tough to put together a full-benefits retirement age for the vast majority of workers. The "savings" goes from those with easier jobs to those with tougher ones, and inequality of condition often requires inequality of treatment of different groups of people. Nobody would be more than a year's worth of difference from a category they thought they deserved to be in, and for the 40% of the people with the toughest (often lowest-paying) jobs, they would see a benefit from the current age of 67.

I feel it represents a positive change that we could shape, or we could just deny that the system is headed for insolvency, and let future retirees deal with getting only two-thirds of a calculated benefit because we didn't do something meaningful now.

PETRUS

(3,678 posts)Massive upward redistribution in wealth since the '70s is the reason so many people are not experiencing the benefits of increased productivity. Social Security is never projected to rise to more than 7% of GDP; during the 75 year planning period it actually begins to fall and stabilizes at around 6% of GDP. There is overwhelming support for this program among the public. At 6% or 7% of GDP, funding currently scheduled benefits, or even providing for increased benefits, is trivial. The only reason that doesn't just happen is because a very powerful minority stands in opposition.

FogerRox

(13,211 posts)I'll give you a hint, its not resources, start looking at demographics via increased income disparity.

midnight

(26,624 posts)I've been preparing for nearly a month, right after the Climate Change SOS blogathon I started organizing the DK SSD blogathon. And well its not been going together like clockwork, it is coming together. DK Front Pager Joan McCarter has the Monday 11am EST slot, later on Monday you'll see KitsapRiver and myself.

Tuesday's lineup includes joanneleon & joe shikspack and at 3pm- Arshad Hasan Executive Director of DFA. Wenesday we have Poopdogcomedy (wasn't he on the Conan show?) the Founder of the Social Security Defenders group @DK, Bruce Webb (otherwise known as Mr SS).

Thursday Jim Dean the DFA Chair kicks off the days events @11am. Followed by One Pissed Off Liberal and Floridagal (Madfloridian @ DU). Friday is going to be awesome, Economist Dean Baker starts the day at 11am, if VCLib comes back from vacation in time he has the 1pm slot, and I think I've talked DK Featured writer Armando to finish up the weeks activities.

http://www.dailykos.com/story/2013/03/23/1196505/-Social-Security-Defenders-blogathon-kicks-off-Monday-the-25th

Downwinder

(12,869 posts)TreasonousBastard

(43,049 posts)difficult, if not impossible, to translate into viable policy.

There are also private pension plans that will be affected, and companies will see retirement ages upped and will be tempted to fire older, less efficient, employees rather than offer early retirement.

"Blue collar" might mean low pay in most areas, but I know an electrician who retired a couple of years ago on over 50 grand a year with piles of money in the bank. Dockworkers I knew at Port Newark were making up to 250 grand to build up a pile to retire early. Much better deals than secretaries and marketing types tend to get.

You just can't pigeonhole people according to job type, especially when so many are making career changes. Income? Maybe, but you could find out that secretaries are living longer than their stressed out bosses. And what about non-working spouses? There are still quite a few out there and how would they fit into the calculations?

You can't make the system perfect so don't screw it up trying.

FogerRox

(13,211 posts)When you've had the best of medical care your entire life and you've never done physically demanding work, you live longer.

This sort of info can play into the debate of whether or not to remove the cap and what the implications are.

Removing the cap for a person who makes 20 million a year, and is more likely live into their early 90's, means collecting about $168,000 in SS Benefits a year. If that person lives to age 91, they live 10 years longer than a worker in the bottom 50%.

At age 91, thats 346k per year in SS benefits.

When that worker at the bottom 50% dies at age 81, the rich person will be collecting about 275k a year.