progree

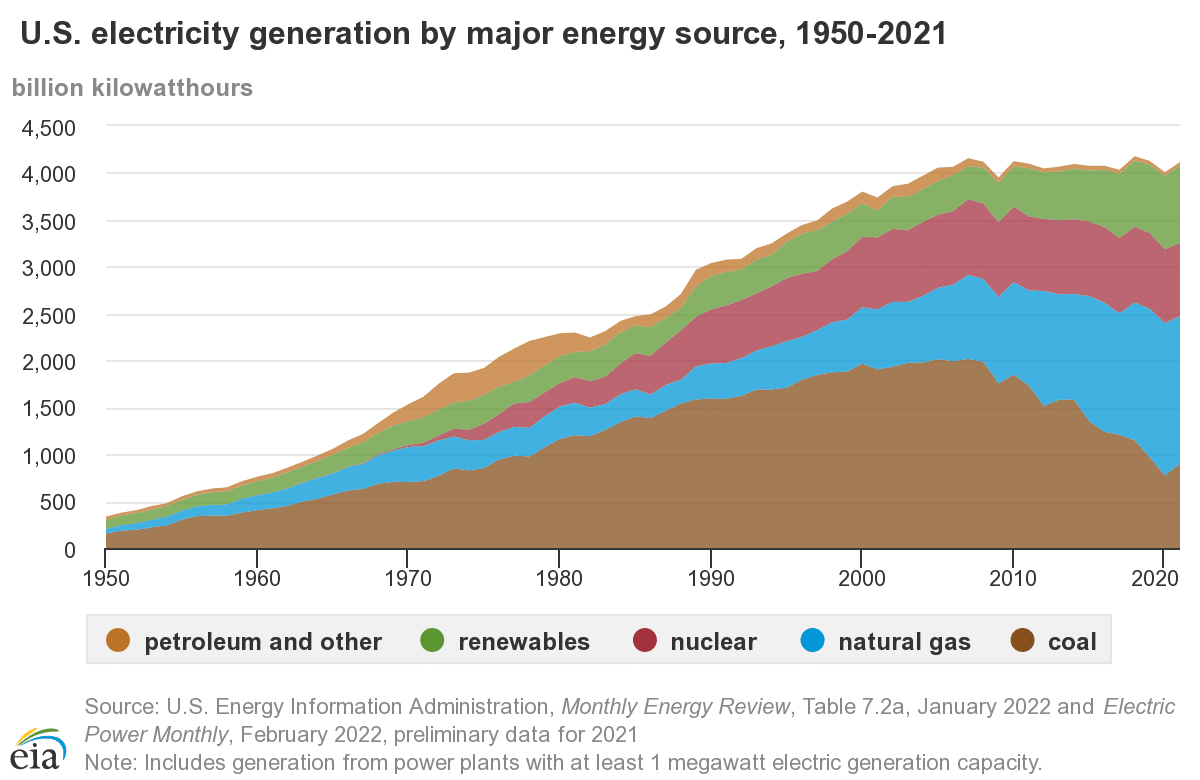

progree's JournalAnd U.S. electricity generation was flat for so long, e.g. 2023 was about the same as 2007 (16 years).

Edited: looking for something later, I found statista in archive.org but the latest figures are just through 2023:

2005: 4,055, 2010: 4,125, 2011:4,100, 2015: 4,078, 2016: 4,077, 2017: 4,034, 2018: 4,178, 2019:4,128, 2020: 4,007, 2021: 4,116, 2022: 4,243, 2023: 4,178 -- so note that 2023 is the same as 2018, so we're essentially talking about a flat spot from 2007 thru 2023 (16 years) /EDIT

It was during those flat years where the carbon emissions from electricity generation went down in the U.S., thanks mostly to natural gas replacing a lot of coal (natural gas is filthy, but only half as filthy as coal as far as greenhouse gas emissions per KWH). And thanks to solar and wind. And finally, that electricity generation and consumption was essentially flat was helpful.

Well, now electricity growth is expected to skyrocket as multiple sources say, it will be next to impossible to keep greenhouse gas emissions from growing at least for the next few years if 25% growth in electricity in just 5 years were to occur.

As for air conditioning load, that is expected to skyrocket too. A small rise in average temperature results in an exponential increase in very hot days:

The graph illustrates that a small shift to the right in the average shifts the whole bell curve to the right, and, in this illustration makes hot weather (orange) much more common and extreme hot weather (red) from almost zero probability to considerable probability

Much more at link: https://www.democraticunderground.com/10143266574#post1

======================================================

Why your air conditioning bill is about to soar - the energy required rises with the SQUARE of the temperature difference

https://www.democraticunderground.com/1127174891

Graphs - rolling 3 month average and month-over-month, both annualized

News report from the source: https://www.bls.gov/news.release/cpi.nr0.htm

CPI data series: https://data.bls.gov/timeseries/CUSR0000SA0

CORE CPI data series: http://data.bls.gov/timeseries/CUSR0000SA0L1E

I annualize everything to be comparable to each other and to compare to the Fed's 2% target

They are calculated using the actual index values, not from the rounded off monthly change numbers.

The CPI rise averaged 1.6% over the past 3 months on an annualized basis (core CPI: 2.1%)

The April one month increase annualized is: CPI: 2.7%, (core CPI: 2.9%)

REGULAR CPI

CORE CPI

Both the CPI and Core CPI 3 month rolling average were helped a lot when the huge January increases dropped out of the 3-month window.

The rolling 12 months averages graphs are in the OP. They were helped by last year's big April 2024 month-over-month increases dropping out of the 12 month window. What drops out of the window is just as important as what enters the 12 month window (which is the latest).

Next month, the rolling 12 month average will not be helped by the "drop out" effect because May 2024 month-over-month increases that are dropping out of the 12 month windows are small: just 0.5% ANNUALIZED for the CPI, and 1.7% ANNUALIZED for the core CPI.

Folks, two negative quarters in a row is NOT officially a recession. The NBER is the widely accepted arbiter of when

recessions occur. (The U.S. government Bureau of Economic Analysis says the NBER -- National Bureau of Economic Research -- is the official arbiter -- see below). Not Internet memes and myths, no matter how common they may be.

https://www.nbcchicago.com/news/local/what-is-a-recession-impacts-jobs-real-estate-economy/3693896/

"conventional definition" -- a common definition would be better wording. But as the article goes on to state, it is not the official definition.

The National Bureau of Economic Research also holds that significant declines in economic activity must be evaluated on their depth, diffusion and duration.

"A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough," according to the Business Cycle Dating Committee with NBER, which officially determines if a recession has occurred. https://www.nber.org/news/business-cycle-dating-committee-announcement-january-7-2008

https://www.nber.org/research/business-cycle-dating

http://www.nber.org/cycles/recessions_faq.html

which morphs into:

https://www.nber.org/research/business-cycle-dating/business-cycle-dating-procedure-frequently-asked-questions

Q: Why doesn't the committee accept the two-quarter definition?

Q: When did the NBER become the quasi-official arbiter of US business cycle dates?

https://www.google.com/search?q=is+the+nber+the+official+arbiter+of+when+recessions+occur

From the Bureau of Economic Analysis (BEA.gov) https://www.bea.gov/help/glossary/recession

This is especially significant because the BEA is the government organization that produces the GDP numbers.

GRAPHS CPI: Rolling 3 month averages and month-over-month, all are annualized

News report from the source: https://www.bls.gov/news.release/cpi.nr0.htm

CPI data series: https://data.bls.gov/timeseries/CUSR0000SA0

CORE CPI data series: http://data.bls.gov/timeseries/CUSR0000SA0L1E

I annualize everything to be comparable to each other and to compare to the Fed's 2% target

They are calculated using the actual index values, not from the rounded off monthly change numbers.

The CPI rise averaged 2.6% over the past 3 months on an annualized basis (core CPI: 3.0%)

The March one month increase annualized is: CPI: -0.6%, CORE CPI: 0.7%

REGULAR CPI

CORE CPI

Both the CPI and Core CPI 3 month rolling average will be helped a lot next month (the April CPI) when the huge January increase drops out of the 3-month window. But who knows what the incoming tariffy numbers for April will look like

rolling 12 months averages graphs are in the OP

But what if the S&P 500 plunges 30% down from its all time high? Wouldn't that pretty much ruin the supposed great long

term record of equities?

The S&P 500 closed Monday April 7 at 5062 -- down 17.6% from its Feb 19 all time high value of 6144 -- so we're more than half way down to the 30% plunge.

Let's see what the situation would be if the S&P 500 closes tomorrow, 4/8/25, at 4301, 30% down from its all time high. What would that do to the S&P 500 long term record? Turn it to an at-best ho-hum plain vanilla return that definitely isn't worth the risk and anxiety?

Source of the year-end values in the upper table:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

What a lump sum $100 investment in the S&P 500 at the end of 1927 would grow to, including reinvested dividends

Then over the last 10.27 years, the S&P 500 with dividends reinvested would still have increased 2.477 fold (a 9.23% annualized rate of return)

And over the last 20.27 years, it would still have increased 5.157 fold (a 8.43% annualized rate of return)

And over the last 30.27 years, it would still have increased 15.943 fold (a 9.58% annualized rate of return)

and so on.

Technical Note - The reason for figuring numbers over the last 10.27 years, the last 20.27 years, etc., rather than the last 10 years, last 20 years, etc. like a normal human would, is because it would be a lot more work; every time I updated this table I would have to look up the S&P 500 adjusted value at 10 years ago, 20 years ago, etc. for a total of 7 such values and then plug them into the speadsheet (Adjusted means taking into account reinvested dividends). More on this at

https://www.democraticunderground.com/1116100100#post2

================================================================

The plunges table - S&P 500 bear market crashes (since 1929, 13 bear markets) with peak-to-trough index drops, with 1-year, 3-year, and 5-year post trough total returns S&P 500 bear markets are when the S&P 500 index closes down 20% or more below a recent high.

"Historically, bear markets have created strong buying opportunities as the S&P was significantly higher 1-, 3-, and 5- years after the trough."

(The 3 worst post-WWII plunges: it has Jan'73-Oct'74 as 48.2%, 3'00-10'02 as 49%, and 10'07-3'09 as 56.8%

https://winthropwealth.com/wp-content/uploads/2023/01/SP-500-Bear-Markets-CQ.pdf

As scary as these are, the important thing to note is that these pullbacks ARE TEMPORARY. It sometimes may take a few years, but the S&P 500 has ALWAYS recovered and gone on to new all-time highs. The table at the top of the post include the entire periods -- with all the corrections and bear markets that occurred. I did not cherry pick just the good parts.

================================================================

Market Correction: What Does It Mean?, Schwab, 3/14/25

https://www.schwab.com/learn/story/market-correction-what-does-it-mean

S&P 500 corrections occur when the S&P 500 index closes down 10% or more below a recent high. Bear markets are when the S&P 500 index closes down 20% or more below a recent high

================================================================

Corrections occur about every 2 years, on average. Bear markets occur about every 7 years, on average.

In the face of inflation and withdrawals, a balanced portfolio -- with a large percentage equity allocation (but not 100%) for a retiree -- lasts longer and has much less chance of running out of money in say 30 years than does a "safe" all fixed income portfolio (bonds, CDs, money markets etc.). This has been shown by innumerable simulations.

Re: withdrawals: a common model is assuming a retiree withdraws 4% of their portfolio in the first year of retirement, and increases the dollar amounts of the withdrawals in subsequent years by the rate of inflation. That "4%" is a common base assumption but simulations have been done at many different levels of withdrawal rates.

GRAPHS (they provide so much additional perspective).

I annualize them all to be easy to compare to each other, and to compare to the FED's 2% goal. I use the actual index values rather than the one-digit changes that are commonly reported in the media. Links to the data are with the graphs.

ALL the numbers are the seasonally adjusted ones

The "1 month" number is the change from January to February expressed as an annualized number.

The "3 month" number is the growth over the last 3 months (and then annualized). It is calculated based on the change in the index number between the latest one and the one 3 months previous. e.g. if the latest index value is 304 and the one 3 months previous is 300, then the 3 month increase is 1.333333%

. . . (304/300 = 1.01333333 => [subtract 1 and multiply by 100%] => 1.333333%)

Annualized, it is 5.4%

. . . (1.01333333^4 = 1.0544095 => [subtract 1 and multiply by 100%] => 5.44095% => 5.4%).

. . . Most people just multiply the 3 month increase by 4 to annualize it: 1.333333%*4 = 5.333333% => 5.3% which isn''t technically correct (it leaves out compounding) but it is close for small percentage changes.

"Regular" is the "headline" number that has "everything"

"Core" is the regular with food, energy, and trade services removed (The Fed prefers this as a basis for projecting FUTURE inflation. Backtesting has found this to be true. ).

WHOLESALE INFLATION (PPI - the Producer Price Index)

https://www.bls.gov/news.release/ppi.nr0.htm

As for which core PPI measure, since the BLS highlights the one below (without food, energy, and trade services) in its reporting (as opposed to the one without food and energy), then I guess I should do likewise. Trade services bounce around a lot from month to month, so I think excluding them from a core measure is the right thing to do.

To summarize:

Latest 3 months average annualized: Regular PPI: 4.3%, Core PPI: 3.6%

Latest month annualized: (February over January): Regular PPI: -0.2%, Core PPI: 2.5%

CORE PPI (excluding food, energy, trade services) through February that came out 3/13/25:

CORE PPI (seasonally adjusted) http://data.bls.gov/timeseries/WPSFD49116

===========================================================

Regular PPI through February that came out 3/13/25 ( includes "everything" ):

Regular PPI (seasonally adjusted) http://data.bls.gov/timeseries/WPSFD4

If we claim February as being part of the Biden economy, then whose economy does December and January belong to?

===========================================================

If one doesn't believe my graphs, one can generate their own from these links:

CORE PPI (seasonally adjusted) http://data.bls.gov/timeseries/WPSFD49116

Regular PPI (seasonally adjusted) http://data.bls.gov/timeseries/WPSFD4

For whichever link you want to check, click on the link,

near the top right side is "More Formatting Options". Click on that

On the left side of the page that appears, click on these checkboxes:

Original Data Values, 1-Month Percent Change, 3-Month Percent Change, and 12-Month Percent Change.

Change the "Specify Year Range" to 2024 to 2025

Click Retrieve Data.

They don't annualize their numbers, but one can approximately annualize their 1-month numbers by multiplying by 12, and their 3-month numbers by multiplying by 4. (see top of this post on how I annualize using the actual index numbers).

Realize they start at January 2024 (when you specify the year range as 2024 to 2025) whereas my graphs start with February 2024.

I do this sanity check every time I post graphs like these (except for the PCE inflation which is produced by the Commerce Dept and one can't generate graphs like these straight from anything I know of).

Edited to add the 12 months averages graphs (same as Year Over Year) from the BLS links using the above method

Core PPI, 12 month rolling averages:

Regular PPI 12 month rolling averages:

Latest 12 month average : Core PPI: 3.3%, Regular PPI: 3.2%

GRAPHS - 3 month rolling average, and one month - both annualized. CPI and Core CPI

News report from the source: https://www.bls.gov/news.release/cpi.nr0.htm

CPI data series: https://data.bls.gov/timeseries/CUSR0000SA0

CORE CPI data series: http://data.bls.gov/timeseries/CUSR0000SA0L1E

I annualize everything to be comparable to each other and to compare to the Fed's 2% target

They are calculated using the actual index values, not from the rounded off monthly change numbers.

The CPI rise averaged 4.3% over the past 3 months on an annualized basis (core CPI: 3.6%)

The February one month increase annualized is: CPI: 2.6%, CORE CPI: 2.8%

REGULAR CPI

CORE CPI = CPI less food and energy

rolling 12 months averages graphs are in the OP

One reason for the decline in the 12 month average aka year-over-year is that the big Febrary 2024 increases dropped out of the 12 month window.

CPI increase in February 2024: 0.40% (4.86% annualized)

Core CPI increase in February 2024: 0.37% (4.54% annualized)

The number dropping out of the 12 month window is just as important as the one entering the 12 month window.

If the incoming number is lower than the outgoing number, then the 12 month average drops, plain and simple. (Similarly with any n-month rolling average).

Yes, it can happen. I reported a broken crosswalk button that has been that way since August

It was in the city of Crystal, Minnesota, an inner-ring suburb of Minneapolis. I found a contact form on the city's website on January 31 or so. I got an email from the Streets Superintendant on Feb 3 that they had not known about this before, and thank you, and hopefully it will be repaired sometime this week.

I found it working on February 14. (I don't know exactly what day it was repaired. My last 2 visits to that area were on Feb 5 (not repaired) and Feb 14 (repaired), so it just might have been repaired sometime that first week, or the week following).

I had thought it would be such a minor concern that nobody would respond, and nothing would be done, so why bother to look up how to contact them and write something. Also, the button housing was very visibly dangling by a wire from where it's supposed to be, for at least 6 months, so I had figured they would have known about it before. So it's nice to see that one can actually make a difference.

It's a busy 4-laner that I have to walk 3-4 heavy bags of groceries across (plus wearing a heavy backpack stuffed with groceries), and while it was broken, there was no walk-cycle. Others carrying grocery bags also use this crosswalk which is in front of the grocery store and goes across the street to the west-bound busstop -- another reason to think it probably was reported multiple times in the past, and so why bother.

ETA: I sent the Streets Superintendant a note of appreciation /EDIT

Anyway, just to encourage people to report "minor" issues.

GRAPHS - 3 month rolling average, and one month - both annualized. CPI and Core CPI

The Last 5 years were revised for seasonal adjustment factors (my graphs' data bases are updated)

News report from the source: https://www.bls.gov/news.release/cpi.nr0.htm

CPI data series: https://data.bls.gov/timeseries/CUSR0000SA0

CORE CPI data series: http://data.bls.gov/timeseries/CUSR0000SA0L1E

I annualize everything to be comparable to each other and to compare to the Fed's 2% target

They are calculated using the actual index values, not from the rounded off monthly change numbers.

What grabs me is that CPI rise averaged 4.5% over the past 3 months on an annualized basis (core CPI: 3.8%)

The January one month increase annualized is: CPI: 5.8%, CORE CPI: 5.5%

The last 3 months (Nov, Dec, Jan) are the "Trump trade" months. Although he wasn't president in November, December, or most of January (inauguration day was Jan 20), the righties claim that the stock market gains since the Nov 5 election are theirs, and call it The Trump Trade. For consistency, they need to own the CPI for those months as well, when businesses scrambled to adjust their inventories and supply chains to deal with -- as best they can -- the expected upcoming trade wars.

REGULAR CPI

CORE CPI = CPI less food and energy

rolling 12 months averages graphs are in the OP

Graphs and summary table of all 3 inflation measures (PCE, CPI, PPI)

The inflation situation as of the release of the PCE Inflation Index (Fed's preferred inflation gauge) on 9/27/24. Here is a summary table followed by the graphs.

CME Fedwatch tool (predicts Fed interest rate changes):https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

I annualize them all to be easy to compare to each other, and to compare to the FED's 2% goal. I use the actual index values rather than the one-digit changes that are commonly reported in the media. Links to the data are with the graphs.

ALL the numbers are the seasonally adjusted ones

The "1 month" number is the change from July to August expressed as an annualized number. Except the PCE is the increase from June to July, also annualized.

The "3 month" number is the growth over the last 3 months (and then annualized). It is calculated based on the change in the index number between the latest one and the one 3 months previous. e.g. if the latest index value is 304 and the one 3 months previous is 300, then the 3 month increase is 1.333333%

. . . (304/300 = 1.01333333 => [subtract 1 and multiply by 100%] => 1.333333%)

Annualized, it is 5.4%

. . . (1.01333333^4 = 1.0544095 => [subtract 1 and multiply by 100%] => 5.44095% => 5.4%).

. . . Most people just multiply the 3 month increase by 4 to annualize it: 1.333333%*4 = 5.333333% => 5.3% which isn''t technically correct (it leaves out compounding) but it is close for small percentage changes.

"Regular" is the "headline" number that has "everything"

"Core" is the regular with food and energy removed (The Fed prefers this as a basis for projecting FUTURE inflation)

Finally, the main summary table

All are seasonally adjusted and ANNUALIZED

PCE-Personal Consumption Expenditures Price Index (Fed's favorite inflation measure)

CPI-Consumer Price Index (retail)

PPI-Producer Price Index (Wholesale prices)

Links to the data are with the graphs below

Average real (i.e. inflation-adjusted) hourly earnings are up over the past 2 years and are above the pre-pandemic level:

. . . # Real average hourly earnings of production and non-supervisory workers: https://data.bls.gov/timeseries/CES0500000032

. . . # Real average hourly earnings of private sector workers: https://data.bls.gov/timeseries/CES0500000013

And now the graphs, in the following order:

* Core PCE and Regular PCE (Core PCE is the Fed's favorite for projecting FUTURE inflation), released 9/27/24

* Core CPI and Regular CPI

* Wholesale inflation - Core PPI and Regular PPI

CORE PCE through AUGUST that came out 9/27/24 (PCE=Personal Consumption Expenditures price index)

CORE PCE (seasonally adjusted): https://fred.stlouisfed.org/series/PCEPILFE

BEA.gov News release: https://www.bea.gov/ and click on "Personal Income and Outlays" or "Personal Income"

This is the one that the Fed weighs most heavily. The Fed weigh the PCE more heavily than the CPI. And in both cases, they weigh the CORE measures higher than the regular headline measures for projecting FUTURE inflation

Regular PCE through AUGUST that came out 9/27/24

Regular PCE (seasonally adjusted): https://fred.stlouisfed.org/series/PCEPI

BEA.gov News release: https://www.bea.gov/ and click on "Personal Income and Outlays" or "Personal Income"

CORE CPI through August that came out 9/11/24

CORE CPI (seasonally adjusted) http://data.bls.gov/timeseries/CUSR0000SA0L1E

BLS CPI news release: https://www.bls.gov/news.release/cpi.nr0.htm

The Regular aka Headline CPI through August that came out 9/11/24 (CPI=Consumer Price Index)

Regular CPI (seasonally adjusted) https://data.bls.gov/timeseries/CUSR0000SA0

BLS CPI news release: https://www.bls.gov/news.release/cpi.nr0.htm

Some Additional CPI Series of Interest

Shelter, which is pretty much all rent -- either regular rent or "owners' equivalent rent", has been a problematic issue -- because changes in new rents take several months before they appreciably move the CPI (because of the inertia of 11 months of older rents). It is the largest component of the Core CPI and one of the largest of the regular CPI. Through August, shelter remained elevated at 0.4% month over month for several months, except for a smaller 0.2% increase in June., and a larger 0.5% increase in August. Year-over-year, shelter is up 5.2%

Shelter: https://data.bls.gov/timeseries/CUSR0000SAH1

Core Inflation less Shelter: https://data.bls.gov/timeseries/CUSR0000SA0L12E

^--This is up 0.0% for 3 months in a row, followed by +0.1% in August. The 3 month annualized average is +0.0% (compare to core of +2.1%)

Click on "More Formatting Options" on the upper right hand of screen, and on the page that appears, choose some or all of: "1-Month Percent Change", "3-Month Percent Change" and "12-Month Percent Change".

Headline CPI and Fed Rate Action

November 2019 through August 2024

The first tentative little quarter point rate increase was March 17, 2022, 12 months after year-over-year inflation went north of 2% in March 2021, and had reached 8.5%.

I'm fond of the 3 month averages as they are an average of 3 data points (so can't be easily dismissed as a "one off", unlike a single month-over-month figure), and they have much more recency than 12 month averages (yoy). I think of them as kinda a smoothed version of month-to-month.

FedFunds Target Rate (I used the upper end of the 0.25% width bracket): https://www.federalreserve.gov/monetarypolicy/openmarket.htm

WHOLESALE INFLATION (PPI - the Producer Price Index)

https://www.bls.gov/news.release/ppi.nr0.htm

As for which core PPI measure, since the BLS highlights the one below (without food, energy, and trade services) in its reporting (as opposed to the one without food and energy), then I guess I should do likewise. Trade services bounce around a lot from month to month, so I think excluding them from a core measure is the right thing to do.

CORE PPI (excluding food, energy, trade services) through August that came out 9/12/24:

CORE PPI (seasonally adjusted) http://data.bls.gov/timeseries/WPSFD49116

===========================================================

Regular PPI through August that came out 9/12/24 ( includes "everything" ):

Regular PPI (seasonally adjusted) http://data.bls.gov/timeseries/WPSFD4

Profile Information

Gender: MaleHometown: Minnesota

Member since: Sat Jan 1, 2005, 04:45 AM

Number of posts: 11,997