Pinback

Pinback's JournalI can't wait for our out-of-town guests to arrive!

Because then the cleaning can stop!!

![]()

![]()

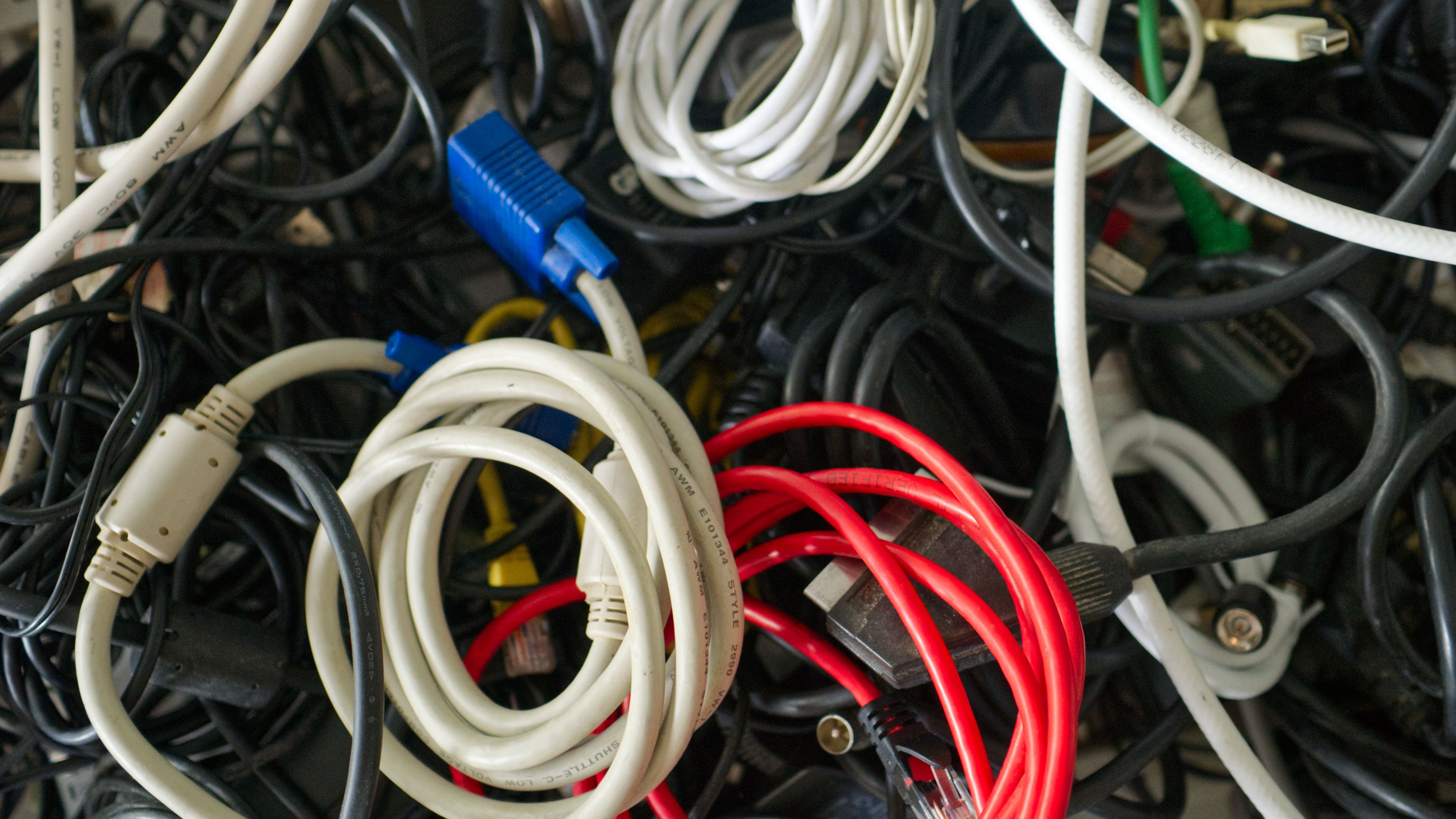

If I can deal with my shameful pile of cables, so can you

- How-To Geek, Nov. 19, 2025

https://www.howtogeek.com/if-i-can-deal-with-my-shameful-pile-of-cables-so-can-you/

By Tim Brookes

Though we live in an increasingly wireless world, cables are still a necessary evil. If you’re anything like me, you just keep collecting them and putting them away just in case you need them at some point in the future.

At this stage, I’ve been collecting cables for decades, so it’s time to deal with the problem.

My pile of shame

I’ve been unintentionally collecting cables since the early 2000s, and in that time, I’ve amassed quite a collection. Despite my best efforts to organize them, they always seem to revert to the same spaghetti-like mess that makes finding anything near impossible. The more you dig, the more they unravel, the more tangled everything becomes.

I try to keep all of these cables together, in a big box, for obvious reasons. There are enough cables in my house without sprinkling 20-year-old phone chargers and deprecated video cables everywhere. When I need something, I venture into the abyss, fish it out, close the lid, and never speak of the horrors I have seen.

- more at link: https://www.howtogeek.com/if-i-can-deal-with-my-shameful-pile-of-cables-so-can-you/

This one hits close to home! I've definitely got a ridiculous collection of things like chargers for long-lost iPods, cables for printers with parallel ports, coax video cables, every kind of obsolete audio cable and patch cord imaginable, etc. etc. etc. Fortunately we have a recycling center around here that will take these off my hands and extract what's reusable.

My motivation is partly the dream of living slightly less encumbered by clutter, but mostly to spare my poor kids the horror of going through all this mess someday when I've transitioned to a collection of unanimated atoms.

Ashe - Aaron Parks and Little Big

Ashé - original composition by pianist Aaron Parks. Performed at SFJazz, May 2025:

Chaos reigns, which I imagine is the goal.

Until they can outright ban vaccines, Kennedy's loony cosplayers at the crippled CDC seek to at least slow down immunizations by requiring prescriptions or physician consultations, and sowing confusion and disinformation about what the requirements are in each state.

Here in Georgia, I'm seeing the following:

- Costco - Allows me to schedule a vaccine appointment, but displays this disclaimer: -- "For COVID vaccinations:

A prescription from a medical provider is currently required for the pharmacy to administer a COVID vaccine in the following states: AZ, DC, GA, HI, IN, LA, MO, OR, SC, UT." - CVS - "The updated 2025 – 2026 COVID vaccine is now available. Appointments may be limited or unavailable in some states. Check back soon for additional availability." Website allows me to choose "COVID-19 (new)" vaccine. When choosing "Next available appointment at all locations," the response is "No locations match your filters. Search again with different filters or try a new location." (I tried various days, various times, both CVS Pharmacy and Minute Clinic -- no dice.)

- Publix - "Georgia – 12 years and older. Prescription required."

- State health dept. - "Get the COVID-19 Vaccine. The COVID-19 vaccine is available to the public.

Eligible individuals can get the COVID-19 vaccine to protect against severe illness. The vaccine is available at many locations across the state. Stay up to date on the latest information by following advice from the Georgia Department of Public Health, your local county’s health department (link), and your healthcare provider or primary care physician." - County health dept. - "Vaccine Notice -- The updated COVID vaccines are not available yet. The COVID vaccines just approved by FDA have not shipped, and the estimate for when they will ship is mid-September." (Today is Sept. 21...)

Also, here's what's on the CDC website, as of this writing, at https://www.cdc.gov/vaccines-adults/recommended-vaccines/index.html:

"All adults need these routine vaccines

Everyone should make sure they're up to date on these routine vaccines:

- COVID-19 vaccine

- Flu vaccine (influenza)

- Tdap vaccine (tetanus, diphtheria, and whooping cough) or Td vaccine (tetanus, diphtheria)"

Oh, goody! The CDC agrees that the COVID-19 vaccine is important!

Lee Morgan - Yes I Can, No You Can't (remastered)

Vi Redd with the Count Basie Orchestra - Stormy Monday Blues

Cinema Paradiso - Grgoire Maret and Romain Collin

How to Find Private Prison Stocks in Your Portfolio

This article from Morningstar Investing Center discusses the two largest publicly held private prison companies today and how to tell if they're lurking in your portfolio. As you'd expect from Morningstar, they provide details based on extensive research and offer insights into assessing your exposure to these stocks as well as some guidance on how to invest without throwing any of your retirement dollars their way. Useful information for investors looking for ethical choices.

https://www.morningstar.com/sustainable-investing/how-find-private-prison-stocks-your-portfolio

In recent years, exposure to private prisons has become a concern to values-based investors seeking to exclude such securities from their portfolios.

In the United States, two publicly traded private prison companies dominate the market: The GEO Group GEO and CoreCivic CXW. Modern private prisons emerged in the 1980s as the prison population increased, partly because of the so-called war on drugs, and the US government began contracting with private companies. The predecessors of both companies became REITs to take advantage of related tax benefits in 2013 and converted to C corporations in 2021. Since then, they have maintained steady contracts with the Bureau of Prisons, US Marshals, and US Immigration and Customs Enforcement.

Aside from making direct purchases of these equities, investors may also be exposed to GEO and CoreCivic by owning index funds whose benchmarks contain these stocks. We highlight the four largest equity funds in our database that are exposed to both private prisons operators, the top 20 funds with the largest allocations to each stock, and, lastly, the top 20 US equity funds with no exposure to these securities.

Since the election of the new presidential administration, these stocks have rallied. But for many investors, including values-based investors, private prisons are a source of conflict. For conventional investors, they can also represent political and other risks.

- More at link: https://www.morningstar.com/sustainable-investing/how-find-private-prison-stocks-your-portfolio

For more on this topic, see As You Sow's Prison Free Funds Tool (https://prisonfreefunds.org) - "Find mutual funds and ETFs that avoid the prison industrial complex."

Such considerations pose a particular challenge for conscientious Bogleheads who want to invest in broad-based index funds without supporting objectionable companies and industries.

5 Expensive Mac Apps I Don't Regret Paying For (How-To Geek)

FYI, I came across this article and thought it might be of interest to this group. Of these I have only Alfred (which I don't use very often) and an older version of Pixelmator (ditto). If you have experience / thoughts regarding any of these, please share. I know I need to up my game in some areas and am always interested in enhancing productivity.

Discussed in the article:

- Alfred 5 for Mac - https://www.alfredapp.com

- Photomator - https://www.pixelmator.com/photomator/

- Pixelmator Pro - https://www.pixelmator.com/pro/

- Ulysses - https://ulysses.app

- Final Cut Pro - https://www.apple.com/final-cut-pro/

https://www.howtogeek.com/expensive-mac-apps-i-dont-regret-paying-for/

Profile Information

Gender: MaleHometown: GA

Home country: USA

Member since: 2002

Number of posts: 13,478